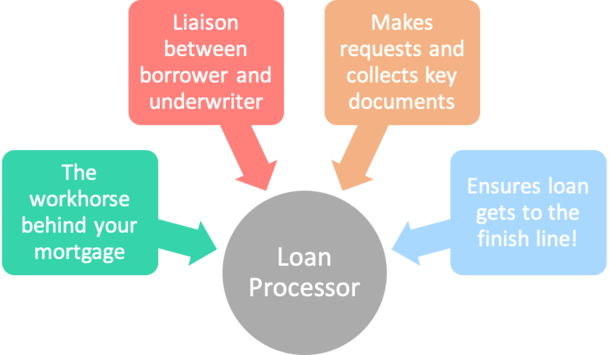

What Do Mortgage Loan Processors Do? In Short, Everything to Close Your Loan!

I’ve already covered the mortgage underwriter’s role, so let’s take a look at what mortgage loan processors do too.

After you speak to a mortgage broker or loan officer and agree to move forward with a loan application, a processor may reach out to gather required paperwork.

This individual is responsible for prepping and organizing your loan file and getting it over to the underwriting department for approval.

Other than that, they can also answer questions, provide status updates, and guide you through the loan process from start to finish.

In that sense, they play an integral role in getting your loan funded while acting as a liaison between you and all parties to the loan.

Loan Processors Are the Workhorse Behind Your Mortgage

- A loan processor’s main function is to assist mortgage brokers and loan officers from application to funding

- They compile and review important paperwork from the borrower like pay stubs and bank statements

- And look out for any red flags along the way that could create issues or headaches

- They also communicate with all parties to the loan from start to finish to ensure everything goes smoothly

Loan processors, also known as loan coordinators, are very important figures in the home loan process, and often quite knowledgeable about mortgages as well.

They are the loan officer’s right-hand man/woman that assists with loan prep and all the day-to-day stuff that happens from loan origination to loan funding.

This includes gathering paperwork from the borrower, determining loan eligibility, reviewing loan files, submitting documents to the underwriter, answering questions, and communicating with all parties along the way.

They don’t just grab the loan file from the salesperson and submit it; they go over everything like debt-to-income ratios, bank statements, and employment history to ensure the file will actually be approved.

Simply put, their role in the loan approval process is a critical one, as mistakes made by the loan originator could be caught and corrected before the file lands in the unforgiving hands of an underwriter.

And once it gets to the underwriter’s desk, there’s typically no going back.

Assuming the loan is approved, the processor will also receive a list of prior-to-document conditions (PTDs) that must be met before the borrower can sign loan documents and fund their loan.

It is the processor’s job to work with the loan originator, title and escrow companies, and various others to get all the necessary paperwork to fulfill those conditions.

And with so many people involved in the mortgage process, things can get very complicated in no time at all.

The good news is they handle numerous loan files each month and have likely seen it all. This means aside from pushing paper from point A to point B, they can solve problems and put out fires.

You May Spend More Time Working with the Processor Than Anyone Else

- It’s common to talk more with the processor than with the loan officer

- Once you submit your loan application they may be your main point of contact

- Since LOs/brokers main focus is to spend more time selling and finding new prospects

- The good news is loan processors are often very knowledgeable and hardworking individuals

While the loan officer or broker may be the person who “got you the loan” to begin with, it’s the processor that will likely take over once you’ve been “sold” on which company to work with.

That sold part is pretty important because loan processors aren’t supposed to offer or negotiate mortgage rates or discuss the terms of your loan.

Their role is to assist the loan originator, whose job it is to sell you on the rate/product.

However, some processors are actually more knowledgeable than their sales colleagues because they handle more volume and may have many years of mortgage experience under their belt.

And while it might sound odd, you could wind up spending more time on the phone with the loan processor than the loan officer.

After all, the LO will want to get back to finding additional clients, while the processor will be focused on getting your loan closed.

But it’s essentially a team effort, with everyone working together to get you to the finish line with as few hiccups as possible.

In a nutshell, the loan originator hustles to bring in new borrowers and the loan processor hustles to get the loans funded, while both may irritate the underwriter in the process. : )

Loan Processor Job Description

- An individual who prepares and manages the home loan from start to finish

- Acts as an assistant to the originating loan officer or mortgage broker

- Sends out disclosures, collects paperwork from the borrower, reviews documents, and facilitates loan submission

- Creates checklists and sends verification requests to the borrower for needed items

- May order the home appraisal, credit report, HOA documents, and collect insurance information

- Communicates with the loan officer, underwriter, and borrower to ensure conditions are fulfilled once the loan is approved

- Acts as a liaison between all parties, including third-party escrow/title/insurance companies

- Makes sure all tasks are completed and all deadlines met throughout the loan process

Loan Processor vs. Account Manager

If the mortgage is obtained via the wholesale channel (from a mortgage broker), there are essentially two loan processors working together on a single file.

One who works on behalf of the mortgage broker, discussed above. And one who works at the wholesale bank/lender, typically referred to as an Account Manager (AM).

This AM assists an Account Executive (AE), who is essentially the salesperson on the wholesale side of things.

Like a loan processor, the AM will request and review documents from the broker and various third party vendors to ensure the loan closes in a timely fashion.

The AM also acts as a liaison, but between the AE and underwriter. And what they communicate with the AE can be passed along to the broker.

Loan Processor FAQ

Do loan processors need to be licensed?

Some independent processors might need licenses, but those working for licensed mortgage lenders or under the direction of licensed mortgage originators may be exempt. This can vary from company to company and by state.

Do loan processors make commission?

They certainly can and often do. It depends how they set up their pay structure with their employer. They may get paid per loan file funded or a base salary AND a bonus for a certain volume of funded loans each month.

How much do loan processors make per loan?

Again, it depends on the company and perhaps on what their base salary is. If their base is low or nil, they’ll probably make a lot more per loan via commission. The downside is they are then working a performance-based job.

Do loan processors work weekends?

The job might require work on the weekend if a particular lender or broker is busy, or has busy periods. However, many processors just work Monday through Friday like most other bankers.

Do loan processors work from home?

They can work remotely or from home depending on the preferences of their lender or broker. Or if they’re independent they can run their own home office and work with multiple brokers/banks.

What are loan processing fees?

These are very real fees for the loan processor’s hard work. As I mentioned, loan processors might do more of the work once the saleswoman (or man) gets you in the door. This fee could be anywhere from $200 to $700 or more.

Some may refer to it as a junk fee but only if it’s charged on top of a hefty origination fee. Sometimes the latter includes the processor’s work and isn’t a separate line item.

(photo: kozumel)