TotalEnergies: Could Namibia Be Its Guyana Moment? (NYSE:TTE)

JHVEPhoto

I first began covering French Oil & Gas supermajor TotalEnergies (NYSE:TTE) in March when I called it a top pick among European oils. Key reasons for that were 1) Total’s unique outlook among the European majors to actually increase production in the near and midterm, well supported by a 2) leading reserve depth. While I see current developments in Brazil, Uganda and Iraq as main drivers of management’s 2-3% annual production growth target through the decade, stakes in frontier fields in Suriname and Namibia will be key to provide growth optionality post-2030. At currently ~5.8Bboe in oil-rich discovered resource (5.1Bboe of which in Namibia), I estimate those findings to potentially boost liquids reserves by up 23% and carry a current value of ~$10.1B (5% of Total’s market cap). With Galp looking to sell a 40% stake in its giant 10Bboe/$20B Mopane discovery just north of Total’s Namibia block, I see scope for the company to boost its already leading position in the basin as a higher valuation on shares and better debt capacity should provide an edge vs rival European bidders Equinor and Shell.

While I have somewhat lowered my relative preference for Total recently as Shell delivered a blowout Q1 and BP’s valuation discount widened further, the company continues to provide an excellent investment proposition on reserve depth and a low-cost production base. Introducing a different valuation methodology, I adjust my price target to $75/sh. At 13% in price upside and 5% in forward dividends, I see TotalEnergies offering investors up to 18% in total returns and reiterate my Overweight rating. Key risks remain in a deterioration of global macro conditions and/or the oil price environment as well as exploration failures and unplanned up/downstream outages.

[Note: Euro peers include Shell (SHEL), BP (BP), Eni (E) and Equinor (EQNR). US peers are Exxon Mobil (XOM) and Chevron (CVX). All financial information from Total’s most recent quarterly results.]

Key Discussion Points

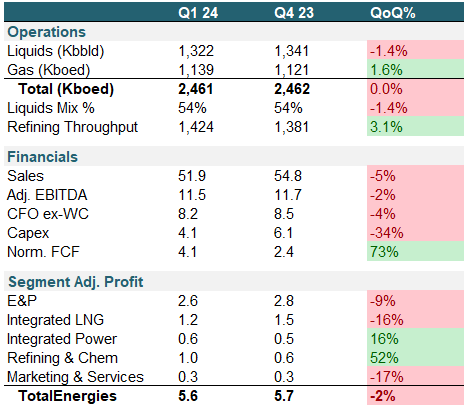

Q1 delivered solid execution with 1% production growth and a ~13% decrease in upstream opex/unit. During Q1 Total’s headline production was stable vs Q4 at 2,461Kboed with a lower liquids output offset by higher gas volumes. However, I do note that the quarter saw the disposal of Total’s remaining oil sands assets. Underlying production was actually up 1% QoQ, driven mainly by growing LNG output (higher gas QoQ) and ramp ups at Mero (Brazil) and Nigeria. Liquids mix remained roughly stable at 54%, well above other Euro majors and refining throughput grew 3% as the Saudi Arabia Satorp refinery came back online.

Financially, sales were down 2% vs Q4 while broadly lower costs (-7%) resulted in roughly stable EBITDA and WC-adjusted CFOs. With (organic) capex down 34%, however, quarterly Free Cash Flow surged 73% to $4.1.

QoQ Matrix (Company Filings)

E&P profits were down 9% on lower headline liquids production and weaker pricing, especially in gas. Unit opex was down 13% for Q1, similarly to developments seen at Shell (see here). Integrated LNG suffered a more severe 16% drop in profits as declining LNG volumes were further exacerbated by significantly lower gas and LNG (JCC/JKM) prices, which were down between 28% and 39%. Integrated Power grew profits 16% on a 20% higher net power production, while Refining & Chemicals income surged 52%, supported by higher throughput in both refining and chemicals and 36% higher refining margins. Marketing & Services, which is Total’s retail fuels business, was down 17% QoQ on lower fuel sales, especially in Europe (-5%).

Driven by strength in power and refining, overall consolidated profits were down just 2% to $5.6B, indicating the value engrained in Total’s strong performing renewables business while peers continue to see profitability issues. Compared to Shell (BP does not report a pure renewables segment), profit margins for Total’s renewable division continue to be around double as high (12% vs 6%).

Namibia and Suriname discoveries boost liquids reserves by up to 23% and provide future growth optionality. In my previous research on Total, I noted its significantly deeper reserve depth as a key competitive advantage to ensure a sustainable production growth. Total was the only Euro major to actually improve its R/P relative to 2018 with Shell and BP (even ex-Rosneft) down materially and Eni flat. As the current developments in Brazil, Uganda and Iraq ramp-up through mid-decade and support management’s target of 2-3% annual production growth, I estimate the substantial new discoveries in Suriname and Namibia to provide growth visibility into the next decade.

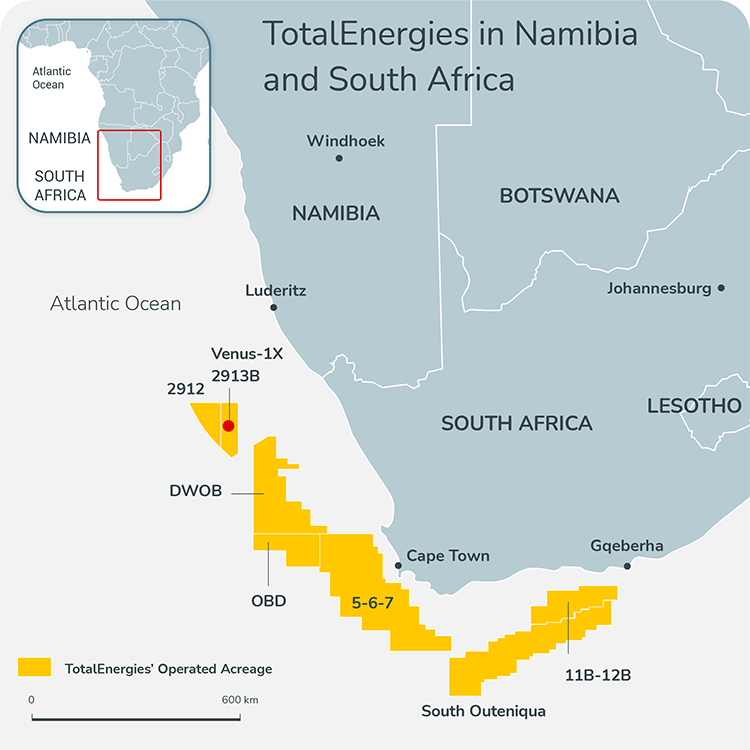

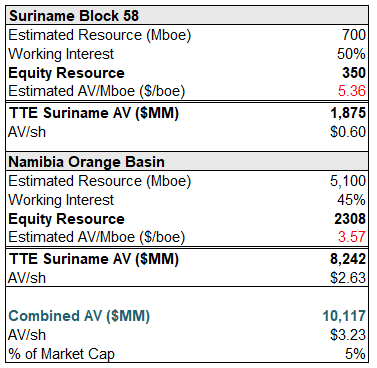

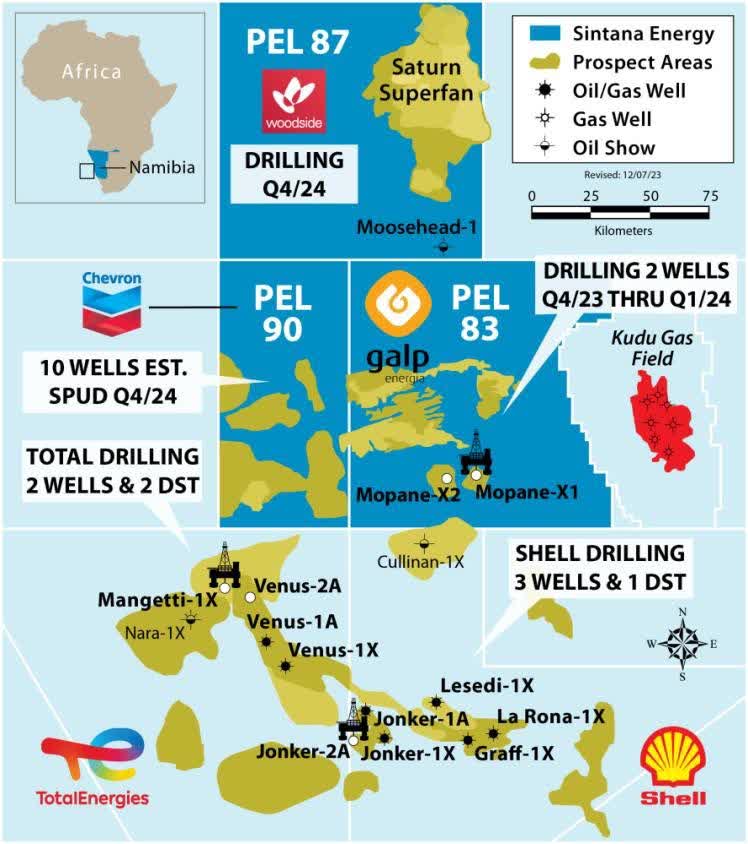

I have previously covered the joint Total/APA position in Suriname, where a 700Mboed discovery in Block 58 is expected to yield FID for a first 200Kboed FPSO later this year. While the Guyana/Suriname Basin has certainly been the star of the show in recent years, an even more significant discovery for Total happened offshore Namibia in what management calls “The Golden Block”. Formally named Block 2913B and part of the Orange Basin stretching from offshore Namibia to South Africa, Total initially held a 40% stake and operatorship in the block before acquiring an additional 5.25% from local partner Impact Oil & Gas. Other interestholders include QatarEnergy and Namibian state oil company NAMCOR. In early 2022 the company made a highly significant discovery in the Venus prospect with NAMCOR, S&P Global and Rystad Energy estimating an oil resource initially in place of around 5,100Mboe (5.1Bboe).

TotalEnergies IR

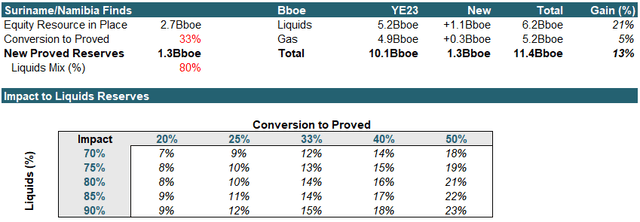

In aggregate, total resource in place across the 2 discoveries is estimated at ~5.8Bboe (~2.7Bboe equity stake). Assuming a 33% conversion into proved reserves and a liquids mix of 80% in line with Guyana and Brazil, I estimate those could provide a 21% uplift to current proved liquids reserves and 13% to overall reserves. I note that while Total’s combined R/P is among the highest in the industry, its liquids-specific reserve coverage is in-line with BP and just slightly ahead of Shell.

Flexing those assumptions with a reserve conversion range of 20-50% and liquids shares of 70%-90%, I find the Suriname/Namibia discoveries could add up to 23% in new liquids reserves in a best case scenario, helping Total to extend its competitive advantage in production longevity from gas to liquids.

Company Filings, WSR Estimates

In trying to assess the discoveries’ value for Total, I employ a similar approach to the one presented in my recent note on APA, Total’s JV partner in Suriname. Assuming an implied valuation of $7.14/boe on Hess’ equity share of the 11Bboe of Guyana resource from decomposing Chevron’s $60B offer and a 25% discount given an earlier status of development, I see the Suriname discovery worth as much as $1,875MM or $0.60 per TotalEnergies share. For Namibia, I assume a higher 50% discount vs Guyana valuation for an implied value of ~$8.2B or $2.63/sh. Combined, I estimate the two discoveries’ value as high as $10.1B, implying ~$3.23/sh or ~5% of current market cap.

Company Filings, WSR Estimates

While Total already has the premier position in Namibia ahead of Shell’s Jonker and Graff discoveries (~4.6Bboe according to NAMCOR), I see additional upside from Galp’s recent 10Bboe discovery just northeast of the Total and Shell operated blocks. Galp, which holds an 80% interest in the field, has announced it would seek to sell half of its stake, worth around $8B according to Bloomberg. Key rumored bidders for the asset include ExxonMobil and Equinor as well as Shell and Total itself. Acquiring an additional ~4Bboe of equity resource in Namibia would solidify Total’s position as leader in the basin and potentially take some weight off the Venus discovery.

Oil & Gas Journal

Financially, I previously noted Total’s best-in-class balance sheet among the Euro majors with current leverage (net debt/LTM EBITDA) and gearing (net debt/total assets) ratios of 0.6x and 9% (Euro majors averages: 0.9x / 11%). At an estimated $8B in asset value, I see ample financial headroom for Total with both a debt- and equity-funded transaction doable. While an all-stock deal would likely be preferential for management given Total’s higher P/E multiple compared to European peers, a debt-funded deal would also be well covered with 24E EBITDA of ~$46.3B resulting in a just slightly higher 0.7x leverage ratio on Pro-Forma net debt of $32.6B.

Valuation Update

While I do not make any changes in key underlying assumptions, I want to use the opportunity to align my valuation methodology to the rest of my O&G coverage (see here for an in-depth explanation).

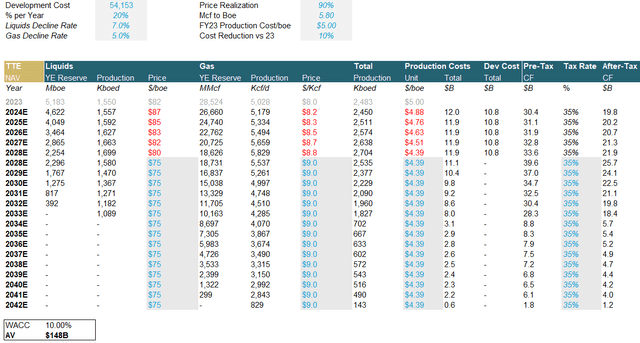

Upstream

Key assumptions are decline rates of 7% and 5% for liquids and gas respectively as well as a unit production cost of ~$5 and a tax rate of 35%. At a fixed 10% cost of capital, I estimate a total value of $148B for Total’s oil & gas producing operations.

Company Filings, WSR Estimates

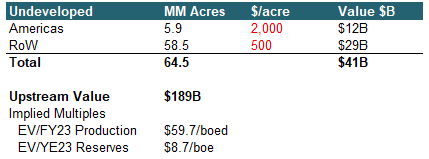

Adding undeveloped acreage valued at $2,000/acre in the Americas and $500/acre in other locations, I see the total upstream value at $189B, implying valuations of ~$60 per flowing barrel and ~$9/boe of proved reserves.

Company Filings, WSR Estimates

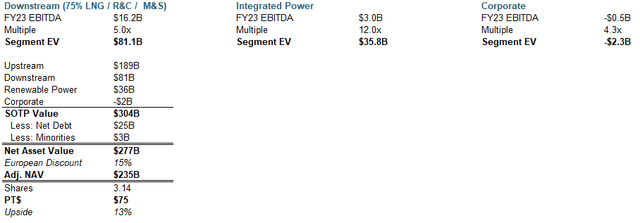

SOTP

For Total’s downstream EBITDA, I consider the entirety of the Refining & Chemicals and Marketing & Services segments as well as 70% of the Integrated LNG division for $16.2B in total. Valuing those at 5x (0.5 turns above the multiple used for Shell’s downstream as weaker LNG is offset by more profitable refining & petchem), I estimate a downstream value of $81B.

I value integrated power at 12x, 2 turns above Shell, given significantly stronger margins and a best-in-class operational track record for a segment value of $36B. Corporate expenses are valued at Total’s current trading multiple of 4.3x for negative $2.3B.

Adjusting SOTP value for net debt and minorities, I obtain a net asset value of $277B. Applying a 15% European discount in line with Shell and below the 20% I use for BP yields an adj. NAV of $235B or $75 per US share for ~13% current upside.

Company Filings, WSR Estimates