I Own These 5 REITs And I Sleep Like A Baby

Kanawa_Studio

I know you’re going to ask me this question:

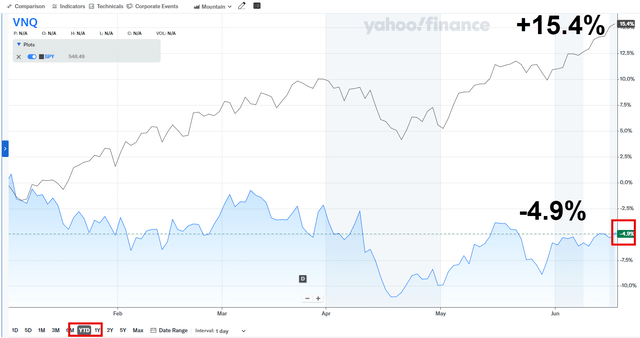

“How can anyone sleep well at night with REITs down almost 5% YTD?”

Yahoo Finance

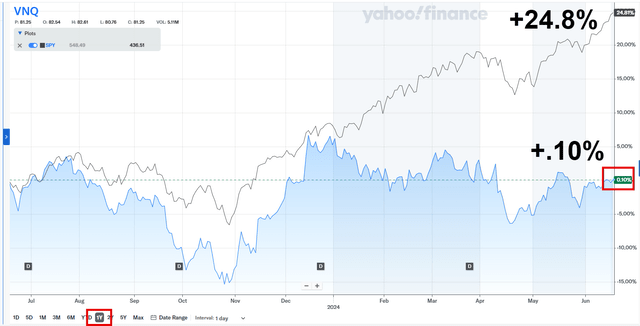

“Or even worse, REITs have underperformed over the past two years.”

Yahoo Finance

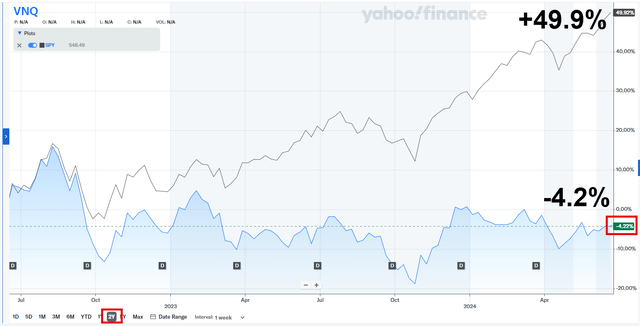

Even more ugly is the 2-year chart below:

Yahoo Finance

Clearly, REITs don’t look like “sleep well at night” (“SWAN”) stocks, quite the contrary, right?

Obviously, sentiment for my favorite asset class hasn’t been promising.

After all, I predicted a REIT Rally would occur in 2023 and 2024.

Yet, no rally so far!

Just crickets.

Of course, I could just blame the Federal Reserve, the ultimate “get out of jail card”…

But I’m not making excuses…

I’ll just eat some more crow…

Or maybe I’ll just buy some more SWANs…

Because they’re cheap.

Mid-America Apartment Communities, Inc. (MAA)

This company is an apartment REIT with a focus on the development, acquisition, and management of multifamily communities that are primarily located in high-growth Sunbelt markets.

MAA is an S&P 500 (SP500) company that has been publicly traded for 30 years. It currently has a market cap of approximately $16.4 billion and a portfolio made up of 102,661 apartment homes spread across 16 states and the District of Columbia.

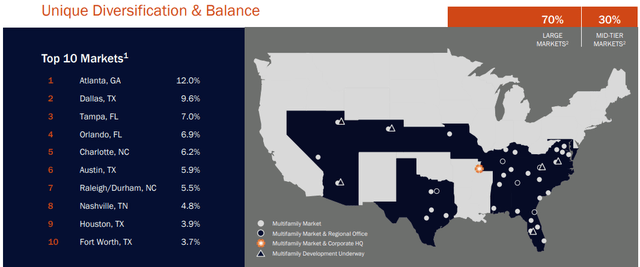

MAA – IR

To maintain stable cash flow through all parts of the investment cycle, the company’s portfolio is diversified across price points, markets, building types, and submarkets.

MAA’s portfolio has a mix of properties in large markets and mid-tier markets. The majority of its properties are in large markets at 70%, while the remaining 30% is located in mid-tier markets.

Its portfolio is also diversified by property type and class, including garden style, mid-rise, and high-rise which range from Class A+ to Class B-.

Mid-America’s largest property type is garden style, which makes up 62% of its portfolio. Garden style apartments typically have 3 floors or fewer. The company’s largest property class is Class A-/B+ apartments, which accounts for 51% of its portfolio.

As previously mentioned, MAA has a strategic focus on markets within the Sunbelt region of the country. Almost all of its top 10 markets are in the Sunbelt, including its top 3 markets.

MAA’s largest market is Atlanta, which accounts for 12% of its same-store net operating income (“same-store NOI”), followed by Dallas and Tampa, which account for 9.6% and 7.0%, respectively.

MAA – IR

What helps me sleep well at night is receiving income from a company that has displayed consistent and reliable performance, as well as a company with a clean balance sheet and conservative leverage. This just about describes MAA.

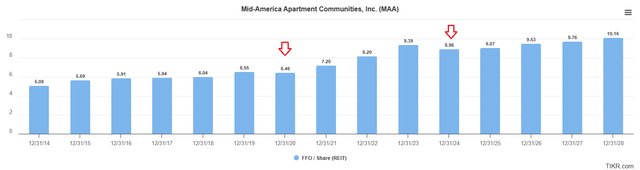

The company has been publicly traded for 3 decades. Over the last 10 years, the company has only had one year of negative FFO growth, which was in 2020. Analysts expect FFO per share to fall by -4.5% this year and then muted growth of +1.1% in 2025.

TIKR.com

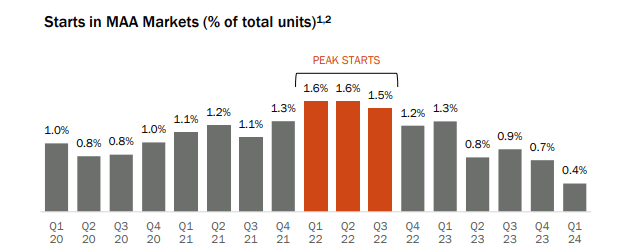

The large volume of new supply in MAA’s markets has been a headwind for the company for some time now.

In its latest investor presentation, the company illustrates how construction starts began to trend downward in the fourth quarter of 2022, implying that new deliveries will follow the same trend with a two-year lag.

MAA – IR

As new supply is absorbed, MAA should have no problem returning to normal growth. Analysts expect funds from operations (“FFO”) per share to increase by +5.2% in 2026 and then by +2.4% the following year.

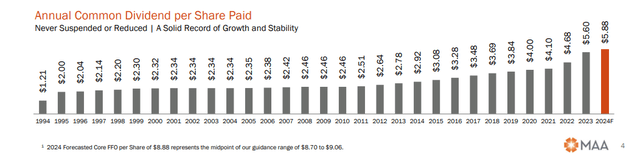

The reliability and consistency of MAA’s cash flow has supported the company’s dividend since it went public in 1994. Over the last 30 years, MAA has never cut its dividend, nor has it ever suspended it.

There have been years since 1994 when MAA only maintained its dividend, but since 2014 the company has increased its dividend each year and delivered an average dividend growth rate of 7.18%.

MAA – IR

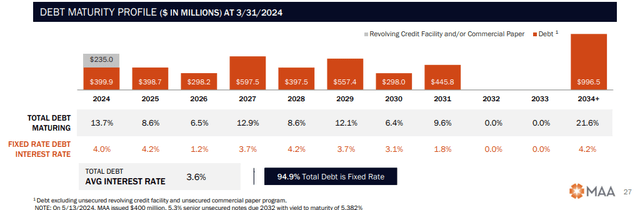

In addition to MAA’s consistent and reliable earnings, it has an investment grade balance sheet and an A- credit rating from S&P Global.

The apartment REIT has excellent debt metrics including a total debt to adjusted total assets ratio of 28.1%, a long-term debt to capital ratio of 37.39%, a debt service coverage ratio of 7.6x, and a net debt to adjusted EBITDAre of 3.6x.

MAA’s debt carries an average interest rate of 3.6% and 94.9% of its debt is fixed rate. Additionally, the company’s debt is well-laddered, with a weighted average term to maturity of 7.2 years.

MAA – IR

Mid-America is a very high-quality REIT. It has a proven business model supported by a fortress-like balance sheet and has created value for its shareholders over the past 30 years.

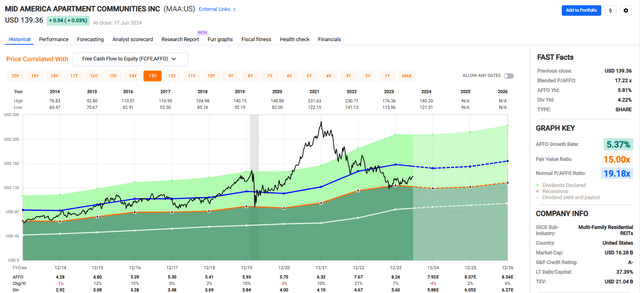

The stock currently pays a 4.22% dividend yield that is very well covered with a 2023 adjusted FFO, or AFFO, payout ratio of 67.96%, plus the stock is trading discounted with a current P/AFFO of 17.22x, compared to its average AFFO multiple of 19.18x.

We rate Mid-America Apartment Communities a Buy.

FAST Graphs

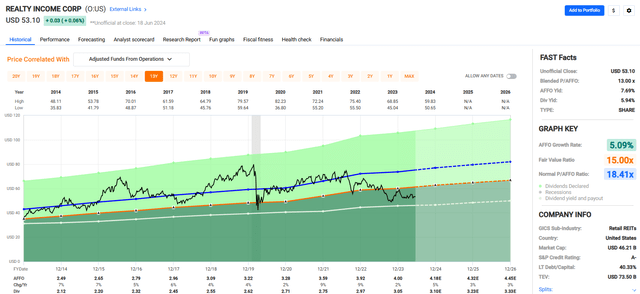

Realty Income Corporation (O)

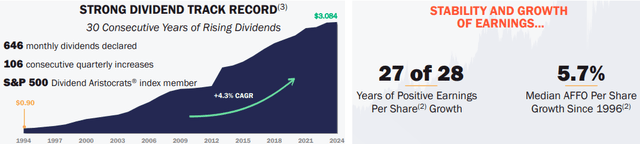

Speaking of consistency, Realty Income is a net lease REIT that has delivered positive AFFO per share growth in 27 out of the last 28 years and median AFFO per share growth of 5.7% since 1996.

The S&P 500 company is a Dividend Aristocrat that has increased its dividend for 30 consecutive years at a 4.3% compound annual growth rate. O has declared 646 monthly dividends and has increased its dividend each quarter for the last 106 consecutive quarters. Pretty consistent.

O – IR

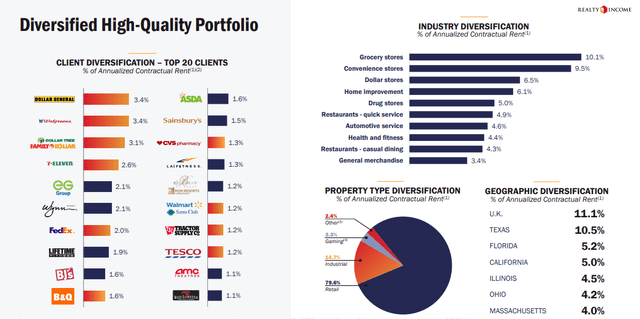

Realty Income’s performance is supported by its 334.2 million SF portfolio consisting of 15,485 commercial properties that are leased to 1,552 tenants on a triple-net basis. O’s properties are located in all 50 states, the United Kingdom, Spain, Italy, Portugal, Ireland, Germany and France.

In addition to its geographic diversification, the company’s portfolio is diversified by property type, tenant, and industry.

The company’s largest tenant is Dollar General (DG), which has an investment-grade BBB credit rating from S&P Global. Dollar General only accounts for 3.4% of O’s annual rent, with 1,760 leases in place at the end of 1Q-24.

In total, O receives 36.3% of its annual rent from its top 20 tenants, and 10 of its top 20 tenants have an investment-grade credit rating.

Realty Income has tenants operating in 89 industries that are primarily defensive in nature, being resilient to economic downturns and resistant to e-commerce. The company estimates that roughly 90% of its rent comes from properties used in defensive industries.

Some of the company’s top industries include dollar stores, convenience stores, quick service restaurants, and home improvement. Its top industry is grocery stores, which made up 10.1% of the company’s annual rent, followed by convenience and dollar stores which account for 9.5% and 6.5%, respectively.

While Realty Income is primarily known for its retail properties, it has a growing number of industrial properties, which represented 14.7% of the company’s portfolio at the end of 1Q-24.

Realty Income’s gaming properties made up 3.3% of its portfolio at the end of the first quarter. The company made several large acquisitions in the gaming space recently, including its purchase of the Encore Boston Harbor Resort and its $950 million investment in the Bellagio in Las Vegas.

More recently, the company entered into an unconsolidated JV with Digital Realty to build two data centers in Northern Virginia.

At the end of the first quarter, O’s portfolio occupancy was 98.6% with a weighted average remaining lease term of approximately 9.8 years.

O – IR

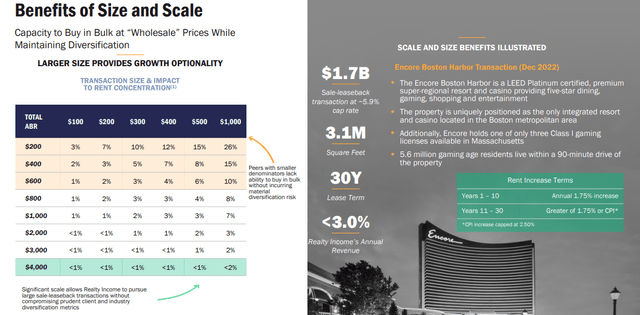

There has been some debate recently on SA about O’s ability to grow now that it has a market cap of approximately $46 billion.

Essentially, the argument is that O’s size will hinder its ability to achieve growth, that normal acquisitions won’t move the needle, so it will require massive acquisition volume just to grow AFFO by a percentage or two.

I’m sure there is much more nuance to the “O is too big” point of view.

I’m not trying to be critical, but I would like to point out that O’s size and scale is precisely why it has been able to achieve growth in this challenging environment.

During 1Q-24 Realty Income invested $598 million at an initial weighted average cash yield of 7.8% with over half of its investment volume coming from the U.K. and Europe. The initial W.A. cash yield for its international investments was 8.2%, which brought the total W.A. cash yield up to 7.8%.

Sumit Roy, the CEO of Realty Income, stated that international growth continues to be key in its ability to generate accretive earnings growth:

“International growth continues to be a differentiating avenue for Realty Income to generate accretive earnings growth as our unique platform allows us to partner with best-in-class clients in a highly fragmented net lease market.”

During the 1Q conference call, Sumit Roy stated that:

“To summarize the results from the quarter, we would highlight several key takeaways. First, diversification. Diversification by geography, asset types and client relationships. We believe our business model is unique in the real estate sector as we have optionality to grow in different regions with investments in a multitude of real estate products where we see superior risk-adjusted returns.”

To paraphrase, Realty Income can grow in different parts of the world and with multiple property types. It has the flexibility to invest across property types and regions to achieve the best risk-adjusted returns.

Another benefit of its size and scale is that it can make investments that are too large for other net lease REITs to make.

A good example is the company’s $1.7 billion sale-leaseback transaction to acquire the Encore Boston Harbor. A price tag of $1.7 billion would destroy tenant and industry diversification for most other net lease REITs.

O – IR

Realty Income is a blue-chip REIT that has delivered consistent operating performance since its IPO in 1994. Its shareholders have been able to depend on its monthly dividend, without fail, for the last 3 decades.

Since 2014, the company has had an average AFFO growth rate of 5.09% and an average dividend growth rate of 5.49%.

Its dividend is well covered with a 2023 AFFO payout ratio of 76.27% and the stock is currently trading at a significant discount with a blended P/AFFO of 13.00x, compared to its average AFFO multiple of 18.41x.

We rate Realty Income a Buy.

FAST Graphs

Prologis, Inc. (PLD)

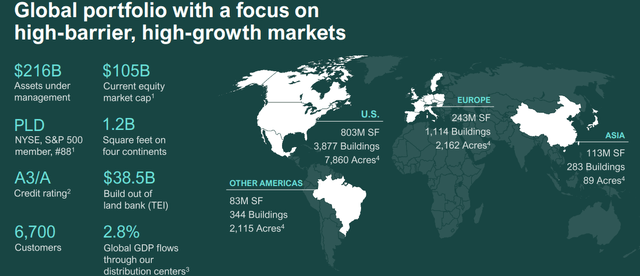

PLD is an industrial REIT that specializes in the development, acquisition, and management of industrial properties that are primarily used for business-to-business transactions and online fulfillment.

The company is enormous with a market cap of approximately $101.9 billion and a 1.2 billion SF portfolio made up of 5,618 industrial properties primarily located in high-barrier and high-growth markets.

PLD’s has a global portfolio that includes properties located in 19 countries and across 4 continents. Its logistics facilities serve a diverse tenant base totaling roughly 6,700 customers that include well-known businesses such as Amazon, Walmart, Pepsi, and Tesla.

The company’s top tenant is Amazon, which accounts for 4.9% of PLD’s rent, followed by Home Depot and FedEx, which account for 1.5% and 1.4%, respectively. PLD’s top 10 tenants only make up 14.4% of its annual rent, and its top 25 tenants only make up 20.4%.

PLD’s network of logistic facilities is critical to global trade. On an annual basis, 2.8% of Global GDP is processed through a distribution center owned by Prologis.

While PLD has a global portfolio, the majority of its net operating income (“NOI”) comes from the United States, which accounts for approximately 86% of the company’s NOI. Europe makes up around 8% and Other Americas and Asia make up 4% and 2%, respectively.

Within the U.S., the company’s largest market is Southern California which holds 545 buildings covering 122,359 SF, or 13.7% of its total square footage in the U.S. After Southern California, PLD’s largest markets within the U.S. are New Jersey / New York and Chicago.

PLD – IR

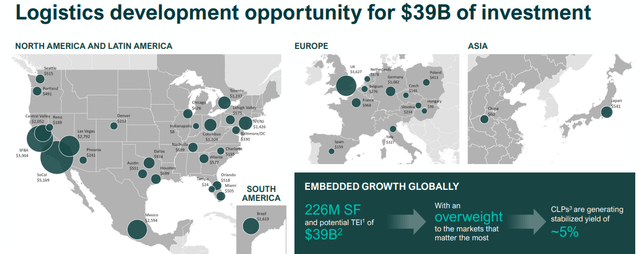

In addition to its operating properties, Prologis has 226 million SF of land banks that can be used for future development. In total, its land banks represent a total expected investment (“TEI”) of roughly $39.0 billion.

Most of PLD’s land banks are located in high-end markets such as Northern and Southern California, Las Vegas, Mexico, and the United Kingdom.

It’s important to note that while PLD’s land banks are not currently producing income, they still represent a material investment for future development and will ultimately contribute to cash flows.

PLD – IR

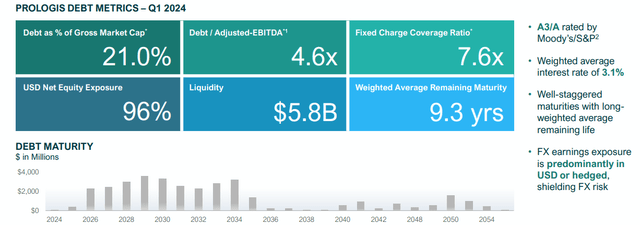

Prologis’ financial position is excellent.

The company has an A3 credit rating from Moody’s and an A credit rating from S&P Global. The company is conservatively leveraged with a debt to adjusted EBITDA of 4.6x and can easily meet its debt obligations with a fixed charge coverage ratio of 7.6x.

PLD’s debt has a weighted average interest rate of 3.1% and is well-staggered with a weighted average term to maturity of 9.3 years. Plus, the company has no significant debt maturities until 2026 and $5.8 billion of liquidity.

PLD – IR

Year-to-date, PLD’s stock price has fallen by roughly -18%. As a result of the pandemic and the increased adoption of online retail, developers piled into industrial properties, which ultimately created a supply glut.

On top of the new supply, economic uncertainties, primarily the volatility in interest rates, have made companies more cautious on investment decisions.

In the company’s first quarter earnings release, Hamid Moghadam, the co-founder and CEO of Prologis, made the following statement:

“While operating conditions are healthy in the majority of our markets, customers remain focused on controlling costs, which is weighing on decision making and the pace of leasing. A volatile and persistently high interest rate environment, together with mounting geopolitical concerns, contribute to this indecision and its short-term effect on net absorption. We remain optimistic about the fundamentals of our business, while being prepared for a slower environment in the next quarter or two.”

In sum, net absorption has been slowing due to the influx of supply plus economic uncertainty. As a result, PLD expects slower sales for the next couple of quarters.

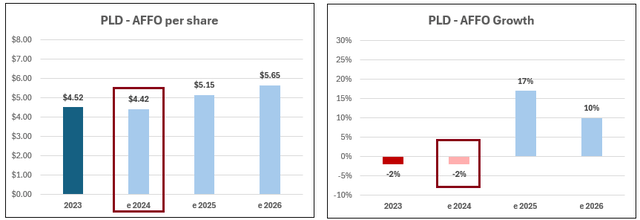

Due to the aforementioned headwinds, analysts expect AFFO per share to fall by -2% in 2024 and then increase by +17% in 2025 and then by +10% in 2026.

FAST Graphs (compiled by iREIT)

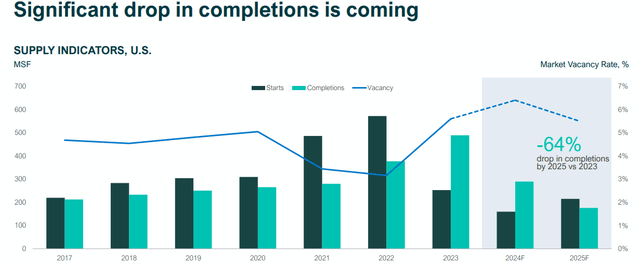

The optimistic projections for 2025 and 2026 are likely because new supply is leveling off and a significant drop in completions is expected over the next several years.

Analysts estimate that starts will drop in 2024 and that deliveries will drop in both 2024 and 2025.

PLD – IR

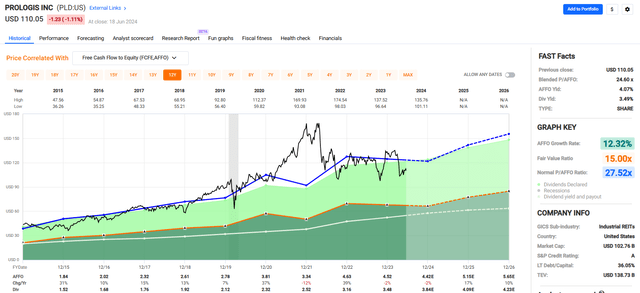

Prologis has been a growth machine over the last decade, with an average AFFO growth rate of 12.32% and an average dividend growth rate of 12.14%. While analysts expect earnings to fall in the short term, over the long term, PLD is set up for growth and is a clear leader in the industrial sector.

Currently, PLD pays a 3.49% dividend yield and trades at a P/AFFO of 24.60x, compared to its average AFFO multiple of 27.52x.

We rate Prologis a Buy.

FAST Graphs

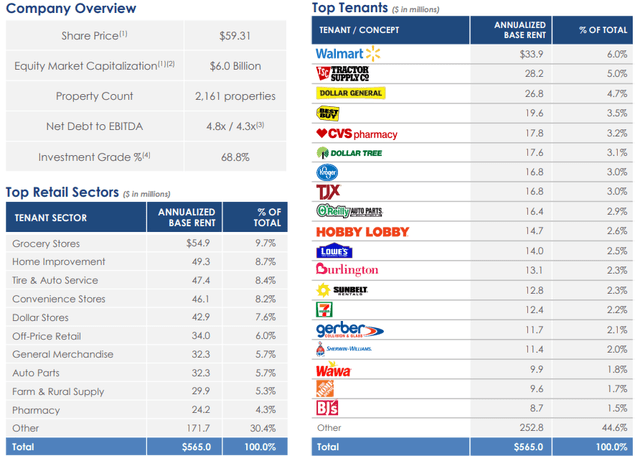

Agree Realty Corporation (ADC)

Agree Realty is a net lease REIT that specializes in the acquisition and development of retail properties. The company has a market cap of approximately $6.2 billion and a 44.9 million SF portfolio comprising 2,161 retail properties located across 49 states.

Many people tend to compare Agree Realty with Realty Income, and understandably so, since both companies are high-quality net lease REITs that pay monthly dividends.

To better understand ADC, I think it is helpful to look at the similarities and differences between it and Realty Income.

- Both companies are net lease REITs

- Both companies primarily invest in freestanding commercial properties

- Both companies target retail industries that are resistant to e-commerce

- Both companies went public in 1994

- Both companies pay monthly dividends

- Both companies essentially own real estate in all 50 states (ADC has properties in 49 states)

- Both companies have excellent management teams with proven track records

- ADC has a market cap of ~$6 billion / O has a market cap of ~$46 billion

- ADC has a BBB credit rating / O has an A- credit rating (both REITs are investment grade)

- ADC only invests in the U.S. / Realty Income owns properties overseas

- ADC is exclusively focused on retail real estate / O invests in retail, industrial, and gaming

- ADC has a ground lease portfolio / O has no material investments in ground leases

- ADC places a very high-emphasis on fungible properties / O primarily owns fungible properties but also owns single purpose assets such as Encore Boston Harbor

- ADC receives 68.8% of its rent from investment grade (“IG”) tenants / O receives 36.2% of its rent from IG tenants.

In many ways, ADC reminds me of a young, smaller version of Realty Income before it expanded into other property types and international markets.

At the end of 1Q-24, ADC’s net lease portfolio was 99.6% leased and had a weighted average lease term of roughly 8.2 years.

ADC – IR

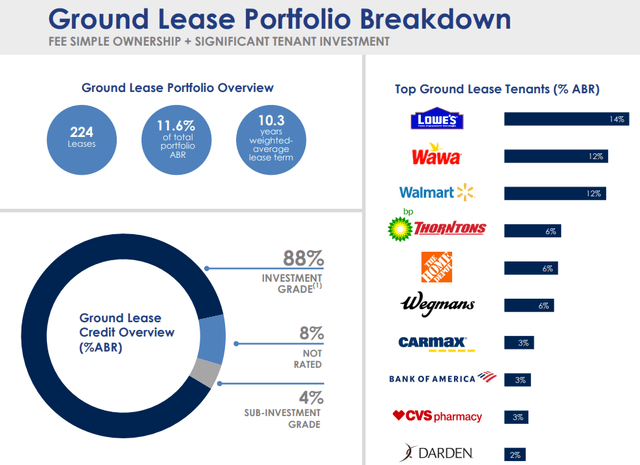

One thing that distinguishes Agree Realty from its net lease peers is the company’s ground lease portfolio that consists of 224 leases with a weighted average lease term of 10.3 years. ADC’s ground lease tenants include Lowe’s, Wawa, Walmart, Home Depot, and Bank of America.

At the end of the first quarter, ADC’s ground lease portfolio totaled 6.1 million SF across 35 states and was fully occupied. 88% of its ground lease tenants are investment grade, and ADC generates 11.6% of its total ABR (annualized base rent) from its ground leases.

ADC – IR

Agree Realty is all about quality. High-quality properties, high-quality tenants, and a high-quality balance sheet.

ADC has an investment grade balance sheet with a BBB credit rating from S&P Global. The company has excellent debt metrics including a net debt to EBITDA of 4.8x, a long-term debt to capital ratio of 33.19% and a fixed charge coverage ratio of 4.9x.

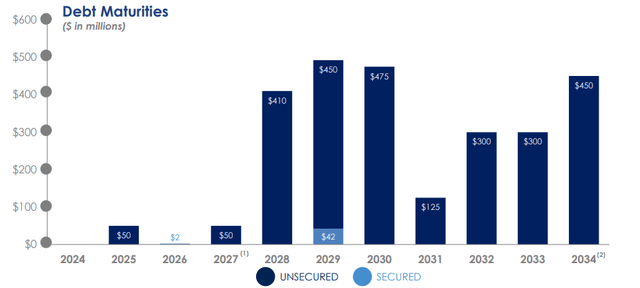

The company’s debt maturities are well staggered with a weighted average term to maturity of roughly 7 years, plus it has no significant debt maturities until 2028.

ADC – IR

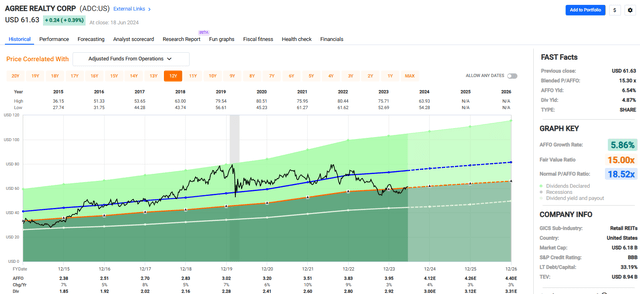

Agree Realty has achieved positive AFFO growth each year since 2015 and has delivered an average AFFO growth rate of 5.86% over this period. Similarly, the company has increased its dividend each year since 2015 and has had an average dividend growth rate of 5.94% over the past 10 years.

ADC pays a 4.87% dividend yield that is well covered with a 2023 AFFO payout ratio of 73.90%. Currently, the stock is trading at a P/AFFO of 15.30x, compared to its average AFFO multiple of 18.52x.

We rate Agree Realty a Buy.

FAST Graphs

VICI Properties Inc. (VICI)

VICI is a gaming REIT that invests in experiential properties, primarily large casinos that feature leading hospitality, retail, and entertainment destinations.

VICI owns iconic trophy properties, many of which are located on the Las Vegas Strip. Some of its more well-known properties in Las Vegas include Caesars Palace, MGM Grand, Excalibur, and the Venetian Resort.

Generally speaking, real estate is highly commoditized, but I believe VICI is one of the few REITs that has a true moat. Its properties are iconic with long histories and cannot be easily replaced.

Any investor with enough capital could build a convenience store, but it would be next to impossible to duplicate Caesars Palace on the Las Vegas Strip. It has intangible qualities, such as its long history, that cannot be replaced.

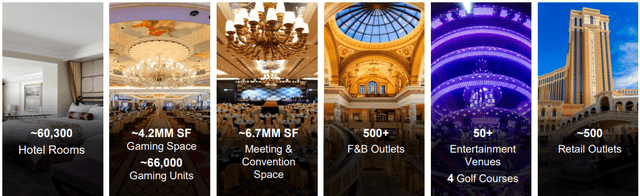

VICI has a market cap of approximately $29.3 billion and a 127 million SF portfolio that consists of 93 experiential assets, including 54 gaming properties and 39 other experiential properties, which are primarily bowling entertainment centers.

The company’s portfolio includes roughly 4.2 million SF of gaming space and features over 60,000 hotel rooms, almost 7.0 million SF of convention space, approximately 500 retail outlets, and more than 500 restaurants, nightclubs, bars, and sportsbooks.

VICI – IR

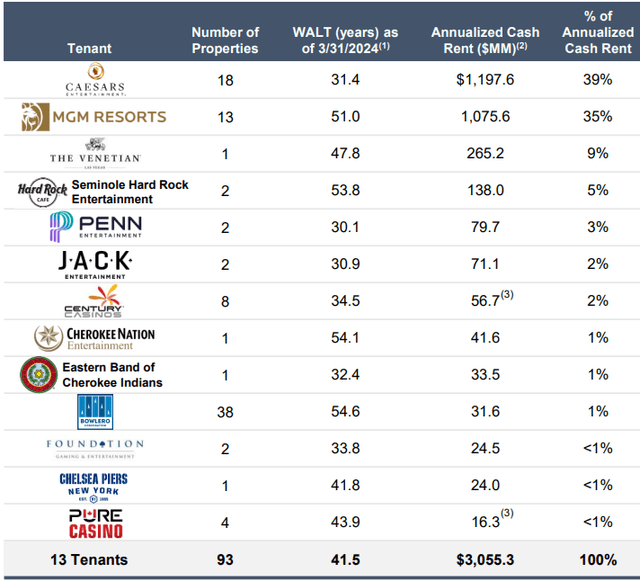

VICI has 13 tenants, but the vast majority of its rent comes from its largest two tenants, Caesars Entertainment (CZR) and MGM Resorts (MGM).

VICI leases 18 properties to Caesars, which account for 39% of its annual rent and have a weighted average lease term (“WALT”) of 31.4 years (inclusive of extensions).

The gaming REIT leases 13 properties to MGM Resorts, which account for 35% of its annual rent and have a WALT of 51.0 years when including extension options.

VICI has high tenant concentration, with its top 2 tenants accounting for 74% of its annual rent. I would normally stay away from a REIT with such a high tenant concentration, but in VICI’s case I don’t see it as a problem.

As previously mentioned, VICI’s properties are iconic and cannot easily be replaced. In addition to the long-term leases, the properties are mission-critical to the gaming operators that manage them. I don’t see a scenario where Caesars Entertainment walks away from Caesars Palace in Las Vegas.

VICI structures its leases on a triple net basis with contractual escalations to mitigate the impact of inflation. The company expects 50% of its rent will be subject to CPI linked escalation in 2024 and 96% of its rent will have CPI linked escalations over the long-term, subject to caps.

VICI – IR

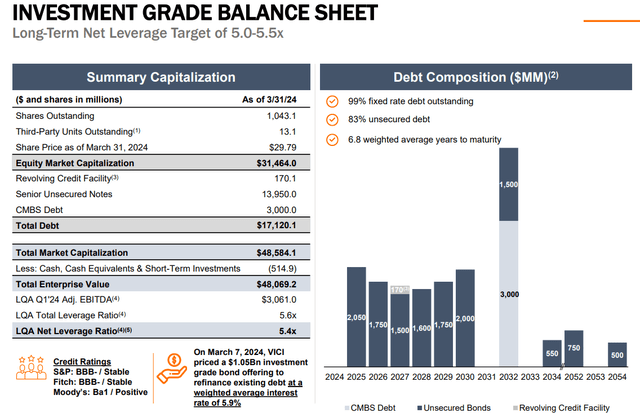

VICI has an investment grade balance sheet with a BBB- credit rating from S&P Global. 99% of its debt is fixed rate and 83% is unsecured.

The company has solid debt metrics including a net leverage ratio of 5.4x, a long-term debt to capital ratio of 40.82%, and an EBITDA to interest expense ratio of 4.19x.

Additionally, its debt is well-staggered, with no debt maturities in 2024 and a weighted average term to maturity of 6.8 years.

VICI – IR

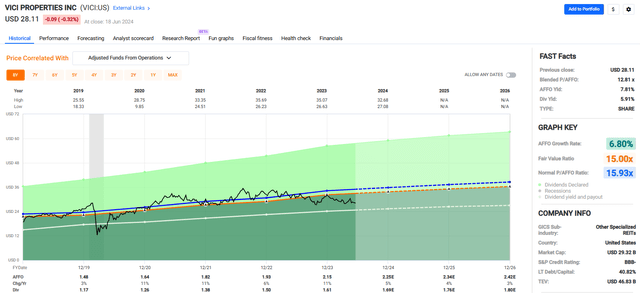

Since 2019 VICI has delivered an average AFFO growth rate of 6.80% and an average dividend growth rate of 10.11%. Analysts expect AFFO per share growth of 5% in 2024 and then 4% the following year.

The stock pays a 5.91% dividend yield that is well covered with a 2023 AFFO payout ratio of 74.88% and is currently trading discounted. Shares are currently trading at a P/AFFO of 12.81x, which compares favorably to its average AFFO multiple of 15.93x.

We rate VICI a Buy.

FAST Graphs

I Sleep Like A Baby

I own all five of these REITs and I sleep like a baby.

In fact, I’ve been buying more shares frequently.

As I’ve mentioned numerous times here on Seeking Alpha, I’ve been a real estate investor for over three decades, and I’ve never witnessed such a time as now.

All five of these REITs own trophy assets with highly experienced management teams.

All five of these REITs are trading with a definitive margin of safety…

With a well-covered (and growing) dividend.

I’ll leave high-yield investing up to the others…

So that I can focus on investing in high-quality dividend growers.

Eventually, REITs will rally.

I’m confident of that!