Apple: Sell The AI Hype (NASDAQ:AAPL)

FinanceYuuji/iStock via Getty Images

Article Thesis

Apple Inc. (NASDAQ:AAPL) is a high-quality company, and its AI presentation got significant attention. But I believe that the financial impact of its new AI offerings will not be especially large, as I will lay out in this article. At the same time, the stock’s valuation has risen to a very elevated level, which does not seem justified by the company’s current operational performance. Locking in gains could be a good idea.

Past Coverage

I have covered Apple Inc. several times here on Seeking Alpha, most recently three months ago in an article focused on a DoJ antitrust lawsuit. My most recent bullish article is from 2019, with Apple returning more than 400% since then. As we will see in today’s article, one of the bullish arguments back then — a high buyback pace — is no longer in place. With the recent AI presentation getting significant attention, and with Apple’s valuation rising even further in the recent past, it is now time to take a look at the company once more.

Apple: An AI Company?

Artificial intelligence has been a major investment theme for a while, and it is very clear that some companies are benefitting in tremendous ways — especially Nvidia (NVDA), which has become the most valuable company in the world on the back of exceptional business growth. Of course, many other (tech) companies try to position themselves in the AI universe as well, although financial success has, so far, not been very common. Even OpenAI, one of the premier AI developers that arguably started the current AI hype with its ChatGPT offering, is generating just $3 billion of revenue per year — which is not a lot of money compared to the hundreds of billions of dollars in revenue that some other tech companies, including Apple, are generating. At least for now, being AI-exposed may result in substantial share price gains, but huge revenues and profits are essentially only being generated by Nvidia, Super Micro Computer (SMCI), etc. — companies that sell equipment to companies that are developing AI services.

Apple has recently had its developer conference where it showcased some AI products and services. This has gotten significant media attention, but Apple will not be a part of the Nvidia-type companies. Apple, after all, will not sell chips to Meta Platforms (META), Alphabet (GOOG)(GOOGL), and so on. Instead, Apple offers some AI services and features with which it may generate profits at some point in the future.

While some of the things that Apple showcased at the event may be of interest to some users (e.g. a revamped Siri), it is, I believe, unlikely that these will turn into huge money-makers in the near term. And yet, Apple’s market capitalization rose by around $400 billion following the event, which is an incredibly large market capitalization increase. For the company’s value to rise this much, Apple would have to see its earnings rise in a massive way — based on what Apple has showcased at the recent event, that seems unlikely to me.

After all, Apple does not generate any additional money when its loyal customers continue to use their current phones. Apple doesn’t even generate any meaningful additional money when its loyal customers continue to update their phones from time to time — if, for example, Apple had 1 billion very loyal users that renew their devices every four years, there is no growth in the number of devices sold. The number of devices sold only grows substantially when Apple gains market share, i.e. when the company makes non-Apple users buy its products in the future. While “switching to Apple” may happen here and there, I do not believe that the tech Apple showcased at the recent event is meaningful enough to make non-Apple users switch to Apple’s products in large numbers (I am an Apple user myself).

First, Apple’s new AI offerings are not really unique. Competitors offer AI smartphones as well, such as Samsung (OTCPK:SSNLF), and Samsung had showcased its AI tech before Apple — there thus isn’t a first-mover advantage for Apple.

Second, not every smartphone or tech device user cares about AI in general, or Apple’s new AI offerings specifically. Not everyone is interested in photo or video editing, and even those who are interested in photo and video editing may not want an AI’s help. Not everyone is interested in a writing assistant, and so on.

Third, many of the people that do not buy Apple’s smartphones and that go with a competitor’s phones instead do so due to the price of an iPhone. In higher-income countries such as the US, Apple has a very high market share already. This, of course, means that the market share can’t grow much anymore. In lower-income countries, spending $1,000 or $1,500 on a smartphone every two or three years simply is a no-go for many consumers — it’s just too expensive. The median per-capita income in the world is $2,900 per year — someone earning that amount of money will never buy an iPhone, no matter how good or interesting its AI features are. Due to its premium prices, Apple’s market share, on a global scale, should thus remain limited.

While Apple has a strong brand for sure, and while its products are well-designed and well-crafted, I believe there are good reasons to believe that its market share will not rise explosively in the near term. Apple’s premium prices, the fact that not everyone cares about AI, and the fact that competitors have AI phones as well mean that the recent AI news will likely not be a major game-changer for the company financially. Will some of Apple’s existing customers like the new features? That will certainly be the case. Will massive numbers of people who have never had an iPhone suddenly buy iPhones? That will, I believe, not be the case. While keeping existing customers happy is good, the latter — gaining market share in a massive way — would be needed to justify the hefty market capitalization gain that was driven by Apple’s AI presentation. When we consider the fact that developing these AI offerings is costly and that the ones making money with AI right now are the chip designers such as Nvidia, not the service providers like Alphabet, Meta, or Apple, then the massive increase in Apple’s share price we have seen in recent weeks does not seem justified.

Apple: An Expensive Stock Has Become Even More Expensive

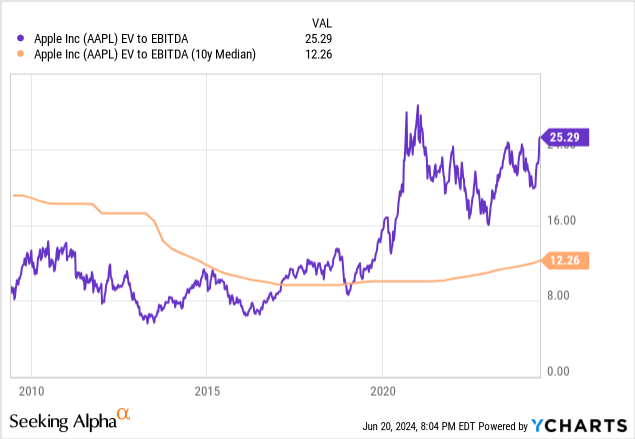

Apple is a quality company, but even when evaluating quality companies, one should consider the stock’s valuation. Today, Apple is trading at one of the highest valuations it has ever traded at, as we can see in the following chart:

Over the last 15 years, Apple has almost never been as expensive as it is today, except for a very short period during the pandemic when everyone was hyping up tech stocks and when interest rates were ultra-low. Today, with interest rates being at multi-year highs, it is hard to fathom why Apple’s 25x enterprise value to EBITDA ratio would be justified — especially since the company’s historic median EV to EBITDA ratio is so much lower. Apple’s share price could be cut in half, and it would only make Apple trade in line with the historic valuation — Apple would not be historically cheap in such a scenario!

While Apple has not been cheap since the pandemic, the company used to be way cheaper — there were times when Apple’s shares could be bought at 7x or 8x EBITDA, despite the brand being very strong back then as well, and despite the fact that the company had a strong balance sheet, nice margins, and so on back then, too. Apple’s gains over the last decade were driven by multiple expansion to a significant degree, and it is far from certain that the valuation will remain this elevated forever.

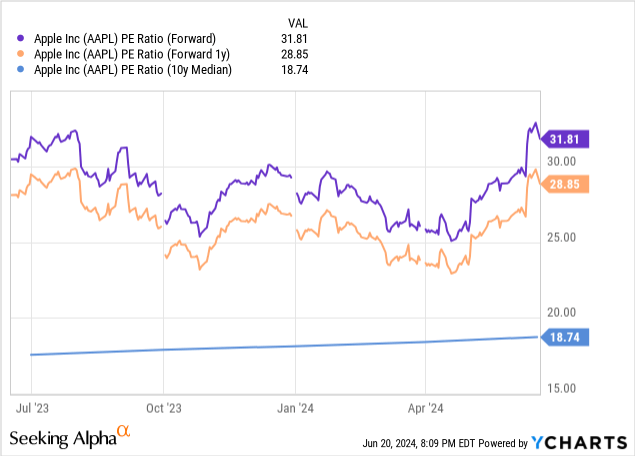

When we look at Apple’s earnings multiple, we see a rather similar picture:

The earnings multiple for the current year is 32, and thus significantly higher than the longer-term average. Even when we look beyond the current year, the earnings multiple remains pretty elevated, at 29. This means the going-in earnings yield for someone buying right here is pretty low, at around 3%, which also means that Apple’s buybacks have become rather ineffective. When Apple was trading at an earnings multiple in the teens, it could buy back shares at a hefty pace. But today, the share count is only declining at a small pace:

Apple’s share count (Seeking Alpha)

Not too long ago, Apple repeatedly managed to reduce its share count by a billion shares a year, hitting a high of 1.4 billion shares being taken out in a single year in 2019. In 2023, Apple’s share count declined by just 500 million. Despite spending more and more cash on buybacks, the share count reduction pace has become a lot smaller. This, of course, means that the positive impact on Apple’s earnings per share growth has become less pronounced as well. While Apple’s buybacks were a huge earnings per share growth driver in the past, that isn’t really the case any longer — which can be explained by the high valuation Apple’s shares are trading at.

Apple: Lock In Gains?

Owning high-quality companies can be great, but even those high-quality companies should not necessarily be held at any valuation. Selling Microsoft at the peak of the dot.com bubble in order to lock in gains would have been wise, while holding on to shares despite the valuation being overly high was not a great idea. The same can be said about the Nifty 50, etc. I believe that Apple has now become so expensive that locking in gains could be a smart idea.

Some of the new AI features look interesting, but AI will likely not be a game-changer financially. And with Apple trading at a very elevated valuation while its buyback machine is becoming less and less efficient, securing one’s gains could be a good idea. I do not recommend shorting Apple, however.