Johnson Controls: Competitive Products And Undervalued Stock (NYSE:JCI)

JHVEPhoto

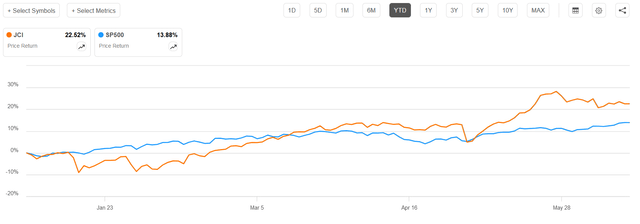

Johnson Controls International plc (NYSE:JCI) shares have surged 22.52% year-to-date, significantly outperforming the S&P 500’s 13.88% gain (see chart below). This strong performance is thought to be driven by the promising outlook of the HVAC (Heating, Ventilation, and Air Conditioning) industry and the company’s unique position within it. Despite the recent stock price rally, I believe that the long-term demand for efficient HVAC products along with the increase in demand for data centers cooling will make JCI a compelling long-term investment opportunity.

Seeking Alpha

Company’s Overview

JCI specializes in intelligent buildings, sustainable energy solutions, and integrated infrastructure and it operates in more than 150 countries. The business is divided into four segments: Building Solutions North America (39% of Fiscal Year 2023 sales), Building Solutions EMEA (15%), Building Solutions Asia-Pacific (10%), and Global Products (36%). JCI’s Buildings business includes the installation and management of HVAC equipment, controls, energy-management systems, security systems, fire detection, and suppression solutions. It also offers technical services, energy-management consulting, and data-driven solutions. The Global Products segment designs and produces heating and air conditioning systems for residential and commercial applications. It also manufactures and sells fire protection and security products.

Industry Trends:

Several tailwinds are shaping the HVAC market, including:

- Continuous increase in demand for HVAC products and services: According to Grand View Research, the global HVAC systems market was worth USD 233.55 billion in 2023 and is projected to expand 7.4% annually from 2024 to 2030. In my opinion, this growth is primarily driven by global warming and the rising demand for energy-efficient HVAC systems.

- Ongoing regulatory changes: The AC industry is subject to stringent and evolving regulations, including those related to refrigerant types, and to the efficiency of HVAC equipment. These regulatory changes drive HVAC companies to constantly innovate their products and encourage customers to upgrade their systems, thereby sustaining demand for new products.

- Demand for data center cooling:

In an article on McKinsey & Company’s website, it is noted that ”US data Center demand is forecast to grow by some 10 percent a year until 2030”. These data centers generate excessive amount of heat and therefore require robust cooling systems to prevent equipment damages.

Company’s Strategic Outlook:

Through acquisitions, JCI was able to position itself as a main provider of smart building solutions, integrated infrastructure, energy-efficient equipment, and data centers cooling solutions. This positioning was particularly achieved through the following strategic acquisitions:

- Acquisition of OpenBlue: As noted on Johnson Controls’ website, OpenBlue is a platform that allows end users to remotely monitor and diagnose system performance. It employs artificial intelligence to make the system more cost efficient, sustainable, more secure, and healthier. In my opinion, OpenBlue is a differentiated technology that could help JCI to capitalize on the growing demand for energy efficiency and to stay ahead of competition in the market.

- Acquisition of Silent-Aire: Silent-Aire specializes in providing cooling solutions for data centers. This acquisition allows JCI to benefit from the increased demand for data centers cooling, providing the company with a lucrative stream of revenues.

- Acquisition of FM:Systems: According to JCI Chairman and CEO, the integration of FM:Systems and OpenBlue will fast track digital transformation, leading to enhanced efficiency and lower operational costs.

I believe these strategic acquisitions will align JCI’s business with the current industry trends, providing a tailwind to boost sales and improve margins.

Financials:

On May 1st, JCI reported their second quarter earnings OF $0.78 per share, beating estimates by $0.03, this is a 4% increase YOY. However, revenue came almost flat at $6.70 billion, missing estimates by $15.74 million. The management blamed the sluggish sales figures to the weakness in China system buildings and to the declines in the global residential HVAC. Despite the low reported figures in revenue, orders increased by 12% and backlog increased by 10% and segment margin increased by 70 basis points. Management believes that their sales growth for 2024 Fiscal year will be mid-single digit and their guideline for EPS remains at $3.60 to $3.75.

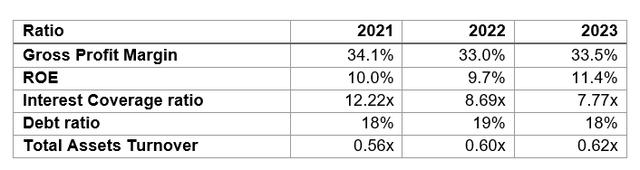

The table below shows that gross profit margin has remained steady over the past three years, while return on equity has slightly improved. Although the interest coverage ratio has decreased, it remains within acceptable ranges. The debt ratio is relatively low at around 18%, indicating minimal solvency risk. Additionally, total asset turnover has increased, reflecting improved efficiency in asset utilization.

Seeking Alpha, Author

Valuation:

P/E Multiples:

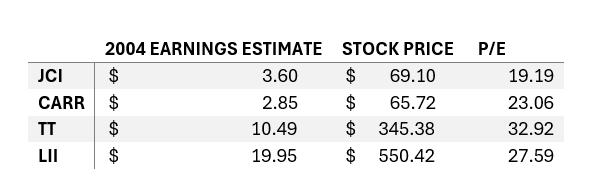

Based on 2024 earnings estimates of $3.6 and the current stock price of $69.1, JCI’s forward P/E ratio is 19.19x.

Comparing this figure with the P/E of JCI’s competitors such as Carrier Global Corporation (CARR), Trane Technologies plc (TT), and Lennox International Inc (LII), reveals that JCI’s P/E ratio is the lowest among its peers, suggesting that the stock price may be undervalued.

Seeking Alpha, Author

Discounted Cash Flow Model:

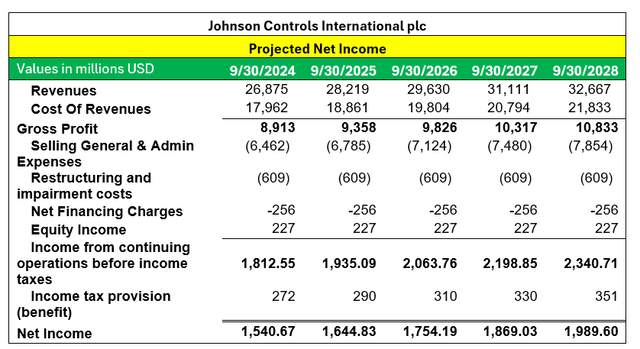

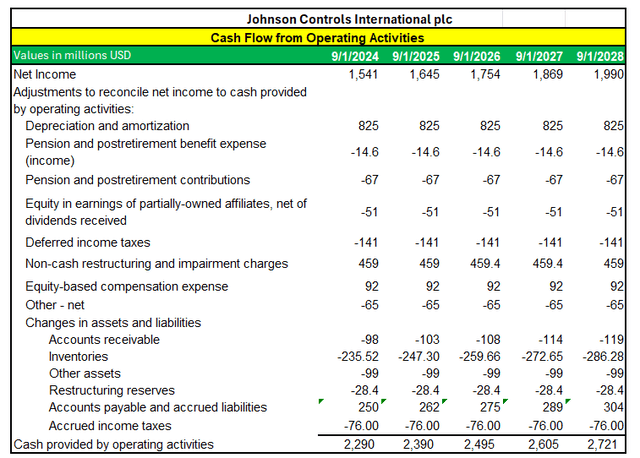

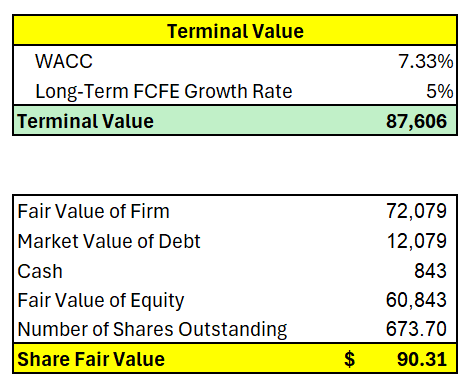

To determine the firm’s fair value, I forecasted the future free cash flow to the firm (FCFF) and then discounted them by the weighted average cost of capital (WACC).

I projected 5% average revenue growth over the next five years, driven by sustained demand for efficient HVAC products and data center cooling.

Cost of revenues and selling general and administrative expenses are assumed to grow in line with sales. While restructuring and impairments costs, net financing charges, and equity income are assumed to be the average of those expenses over the last five years (2019-2023). The average tax rate is assumed to be 15%.

Author

For Cash Flow from Operating Activities (CFO), items directly linked to sales will grow at the same rate as sales, while other elements are assumed to remain constant.

Author

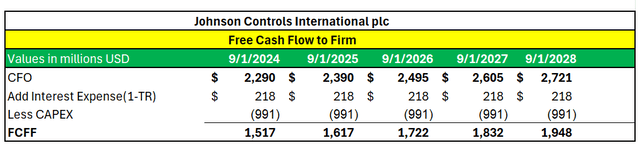

FCFF is given by:

FCFF = CFO + Interest (1-Tax Rate) – CAPEX

Author

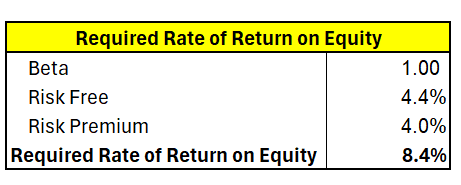

The required rate of return on equity is calculated by using Capital Asset Pricing Model as follows:

Author

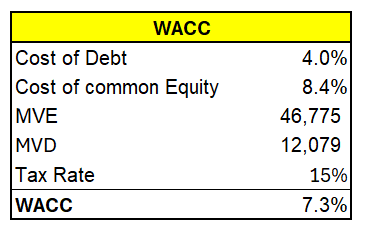

To calculate the weighted average cost of capital, I assumed average cost of debt to be 4%.

Seeking Alpha, Author

Assuming a long-term FCFF growth rate of 5%, the fair value of the stock is $90.30. This fair value represents around 30% potential growth from the $69.10 current market price.

Seeking Alpha, Author

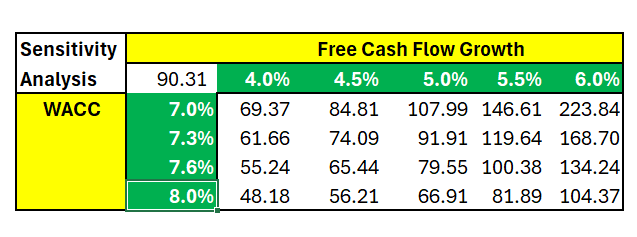

Running a sensitivity analysis, we see that extreme values stand at $48.18 and $223.84.

Author

Risk

In my view, the most relevant risk factor is slowing economic activities. Commercial and residential construction is highly sensitive to business cycles, and a recession would significantly impact Johnson Controls’ revenues. Another less critical risk is a change in regulations and technology. Stricter regulations and changing technology may require additional capital spending, potentially affecting the company’s profits.

Bottom Line:

The HVAC industry has many tailwinds that will support its growth over the medium and the long term. In my opinion, Johnson Controls is well positioned to benefit from a sustainable competitive advantage that could provide economic profits for the coming years. From HVAC equipment, to smart building solutions and data center cooling, I believe Johnson Controls’ business offering is well diversified and highly competitive in a market where only a handful of competitors can provide comparable services. The stock has been recently on a tear; however, I still anticipate potential growth with the stock potentially reaching $90 by the end of this year. Therefore, I give the stock a BUY rating.