NVR Continues To Capitalize On Housing Shortage And High Mortgage Rates

Finance

Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

NVR Inc. (NYSE:NVR) was the first company I covered on Seeking Alpha. I initiated coverage in August 2023 with a “Buy” rating.

The drivers of the business have not changed much since then. Although the stock has slightly underperformed the broader market, I believe the outlook remains positive. High mortgage rates have mixed effects, not solely negative, as the market perceives. Combined with factors such as the housing shortage, the business is still attractive as an investment idea.

The market continues to be concerned about potential demand issues and construction costs. However, I believe supply-demand dynamics are and will continue to be in the company’s favor for longer. The DCF valuation shows that the company is undervalued compared to its potential.

This positive outlook gives me the confidence to reiterate my “Buy” rating.

Business Review

I will keep this company description short, as I’ve provided similar analyses on this company before.

NVR is one of the largest homebuilders in the US. In 2023, it remained the fourth-largest based on gross revenue. The company constructs single-family homes, townhomes, and condominium buildings. Like many other homebuilders, it helps customers with financing through its mortgage business.

NVR joined the trend and decided not to own any land before it started construction. Managing land is not easy, and requires extensive planning long before preparing the building site.

That is why NVR and other large homebuilders are becoming land-light. They work with third-party landowners to take ownership of the land right before the project begins, not holding unnecessary inventory beforehand. This allows the company to be more efficient with its assets and not carry any liability regarding the land.

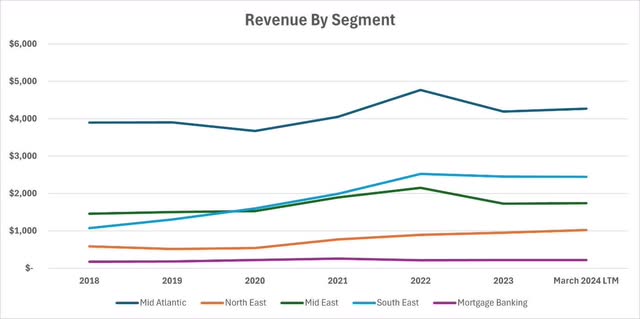

The company’s operations continue to be focused on the Mid-Atlantic region, with South East and Mid East following. The South East segment has seen significant growth, especially compared to other segments.

S&P Capital IQ

Performance Since Publication

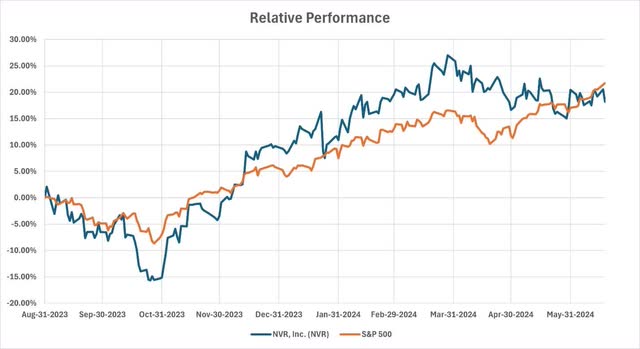

I initiated my NVR coverage with a “Buy” rating on August 31, 2023, and published a follow-up article on January 11th this year to reiterate the rating.

While NVR outperformed the market until my second analysis, it has since been underperforming the S&P 500 index, mainly due to the AI-driven surge in valuations of big technology stocks that comprise a significant portion of the index. Not benefiting from any short-term high-growth plans, the NVR stock lagged behind the broader market.

S&P Capital IQ

Business Drivers Remain Strong

I will first review the housing industry in general and then discuss the short to mid-term outlook. There are various factors to cover that affect NVR’s performance.

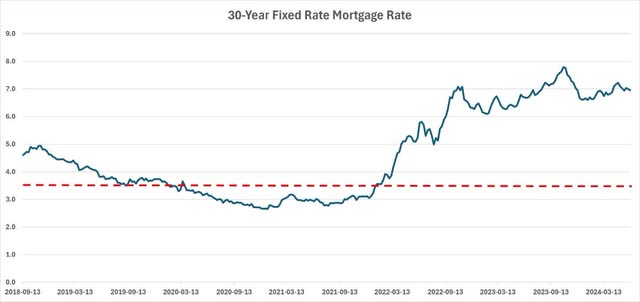

The most important factor first – supply-demand dynamics continue to be driven by mortgage rates. As I’ve explained in previous analyses, homeowners who financed their homes at incredibly low interest rates during a once-in-a-decade opportunity are not willing to sell and buy new homes.

Right after the pandemic, 30-year fixed mortgage rates dropped below 3.5%, and opportunistic buyers took advantage of this to finance their homes. If they sell now, they would have to finance their new homes at rates around 7%. That’s why existing homeowners are locked in their homes. As these houses are not available for sale, homebuyers turn to homebuilders, and NVR continues to benefit from this dynamic.

FRED – Federal Reserve Bank of St. Louis

Additionally, there remains a significant housing shortage that is not possible to fix in the short term. Housing experts say that there are not enough homes available to rent or own compared to the demand. Although there are different estimates, the size of this gap ranges from a shortfall of 1.5 million units to 5.5 million units.

The Biden administration recognizes this problem and has unveiled homebuying initiatives, including tax credits for potential homebuyers.

Another factor increasing the demand for homes, thereby driving long-term returns for NVR, is significant immigration into the West. The US has been seeing increasing immigration, particularly in the South, where NVR is active.

All of these contribute to a positive environment for homebuilders, including NVR. According to Urban Land, new home sales represent as much as 30 percent of all home sales in certain markets, which is higher than the typical 10 percent. Additionally, new home sales are only 4% more expensive than resale homes. Historically, this number was 27%.

Mid-Term Outlook

Although the stock has slightly underperformed the S&P 500 since I initiated coverage on NVR, I believe the mid-term outlook is positive.

Investors have clearly shown that they are waiting for mortgage rates to decline before investing in the stock. Stocks related to new housing jumped after the cooler-than-expected May inflation report. Lower inflation is seen as necessary for interest rates to be cut, as the Fed has taken an aggressive stance to reach its long-term inflation goal of 2%.

This expectation by investors has fundamental backing. Potential homebuyers are waiting for financing to become cheaper and more accessible before buying a house. Homebuilders are aware of this, hence why they are preparing for the demand they will experience when rates are lower. New home construction continues.

Additionally, I agree with the market’s expectation of declining interest rates going forward. According to the CME FedWatch Tool, 66% of investors expect at least one rate cut by October. Declining rates would lead to lower mortgage rates and could encourage potential homebuyers to act.

Until mortgage rates fall back to around 4%, it does not make sense for many homeowners to sell their homes and buy new ones. That’s why I think the demand will continue to be directed towards homebuilders.

Although homebuilder confidence declined in June, there is significant room for improvement over the next two years.

Performance In Recent Quarters

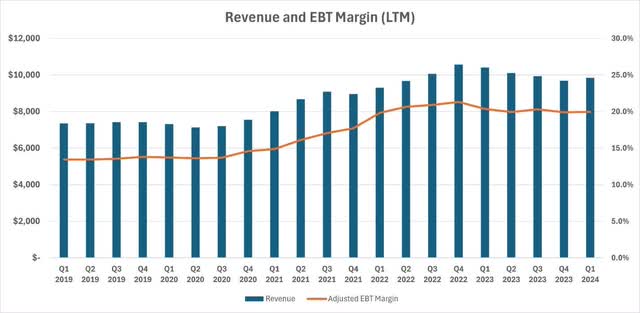

Since 2019, the company has experienced significant growth in revenue and a notable expansion in margins. Its EBT margin excluding unusual items increased from below 15% in Q1 2019 to 20% recently. Last-twelve-months [LTM] revenue is in a slightly declining trend since Q4 2022. However, growth was positive in Q1 2024.

S&P Capital IQ

Based on the macroeconomic dynamics discussed in the previous sections, I expect positive revenue growth and further expansion in margins. This seems in line with Wall Street analysts’ estimates, who expect revenue to increase to $11 billion in 2026.

Valuation

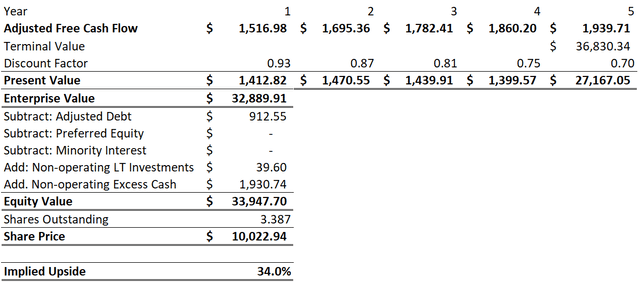

I am using the DCF method to calculate the fair value for NVR. I am applying the same assumptions mentioned in my previous NVR analyses. The only change is the 5-year stock beta, and the cost of debt, which is now 5.18% as the yield-to-worst of the company’s bond slightly increased.

Using these assumptions, we find an equity value of $33.9 billion for NVR, which means a target share price of $10,023. This is a 34% upside at the time of this article’s writing.

Author – DCF Valuation

Conclusion

Although the stock has slightly underperformed the broader market, I remain bullish on NVR. It remains one of the largest homebuilders in the US.

High mortgage rates force potential homeowners to turn to homebuilders, as existing homeowners are not selling. Additionally, rates are probably at their peak, and a decline could increase demand for homes. Other factors like the significant housing shortage and the Biden administration trying to fix this situation through incentives indicate demand for housing will remain high.

Combined with the DCF valuation that implies an upside of 34%, I reiterate my “Buy” rating on the NVR stock.