Syndax: Gearing Up For Launches (NASDAQ:SNDX)

Finance

sergeyryzhov/iStock via Getty Images

This is my second Syndax Pharmaceuticals (NASDAQ:SNDX) article, following 03/2024’s “Syndax Pharmaceuticals: Upcoming Q3 PDUFAs Ignite Hope” (“Hope”). At the time, Syndax was trading at $23.18, I rated it a speculative “Buy” with its rich market cap hovering near $2 billion; currently as I write it trades at $19.26 with a market cap of $1.62 billion.

In this article, I will report on its intervening developments, particularly its Q1, 2024 earnings reported 05/08/2024 in its:

- earnings press release (the “Release”);

- earnings conference call (the “Call”) and;

- 10-Q (the “10-Q”).

In addition, I will cite to its 06/2024 corporate presentation (the “Presentation“) and its latest 10-K (the “10-K”).

Both of Syndax’s upcoming PDUFAs were awarded priority review

As reported in Hope, two of Syndax’s therapies are in line for Q3, 2024 FDA action:

- 09/26/2024 PDUFA — revumenib in treatment of adult and pediatric relapsed or refractory (R/R) KMT2A-rearranged (KMT2Ar) acute leukemia, NDA submitted under the FDA’s Real-time Oncology Review program [RTOR];

- 08/28/2024 PDUFA — Syndax axatilimab collaborator Incyte (INCY) announced its BLA filing, for the treatment of chronic graft-versus-host disease (GVHD) after failure of at least two prior lines of systemic therapy.

Both the revumenib and axatilimab filings were awarded priority review, which is reserved for drugs which provide:

…significant improvements in the safety or effectiveness of the treatment, diagnosis, or prevention of serious conditions…

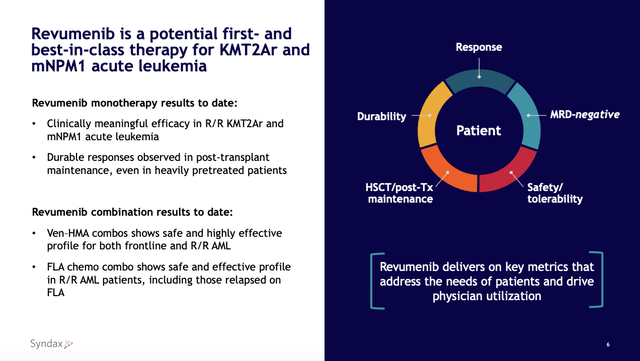

Presentation slide 6 below sets out the revumenib’s attractions to physicians and patients in treatment of specified acute leukemias:

ir.syndax.com

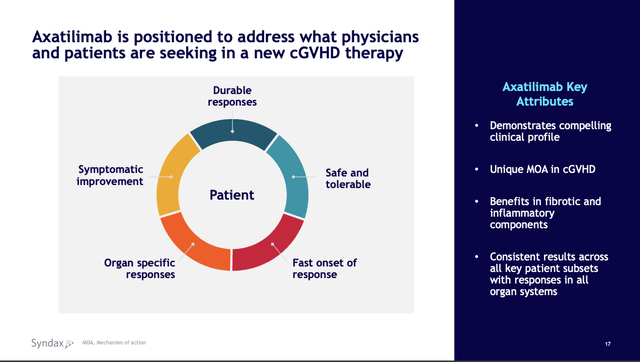

Presentation slide 17 below does so for axatilimab in treatment of cGVHD:

ir.syndax.com

Syndax pegs both upcoming PDUFAs as potential blockbusters once they are approved

During the Call, CCO Closter described the extensive ambitions and preparations Syndax has made in preparation for revumenib’s launch. It has been in discussions with payers and expects a reach >90% of covered lives before its approval.

Importantly, Syndax’s existing revumenib PDUFA addressed KMTAr leukemias. During the Call, Closter explained:

We expect that our first mover advantage and the early experience physicians will gain treating patients with revumenib will be vitally important to the long-term success of our brand. Our significant market share is likely to extend meaningfully beyond KMT2Ar, especially as we will be the first to deliver meaningful pivotal data in other indications such as NPM1 AML. We estimate that the two distinct market segments in acute leukemias, KMT2Ar and NPM1 available accessible population of 5,000 to 6,500 patients in the relapse or refractory setting and an addressable market opportunity that approaches $2 billion in the US.

In other words, its existing revumenib PDUFA which he estimates as opening up a $750 million opportunity in the US is just the tip of a very large iceberg. Between the two revumenib and axatilimab, revumenib is by far the larger opportunity for Syndax.

During the Call, Closter advised that Syndax expected “axatilimab to carve out a sizable commercial opportunity within the estimated $1 billion US refractory chronic GVHD market.”

This is well and good; however, back in 09/2021, Syndax struck a 50/50 profit share deal with Incyte in return for:

- $117 million upfront,

- plus a $35 million equity investment,

- with potential for $450 million in additional milestone payments and

- double-digit ex-US royalties.

Accordingly, it will have to share any axatilimab revenues which substantially limit its axatilimab revenue potential. In terms of longer-term revenues from axatilimab, additional trials are being planned to expand its potential reach. As stated in the Release:

…Incyte plans to initiate two combination trials with axatilimab in chronic GVHD in 2024, including a Phase 2 combination trial with ruxolitinib and a Phase 3 combination trial with steroids.

Despite its exciting near-term opportunities, at its core, Syndax remains a speculative high-risk investment

As discussed above, Syndax has exciting blockbuster near term product revenue potential. Unfortunately, with its swollen market cap of $1.62 billion, it is priced as if it had already realized some of that product revenue. It has not, if the FDA fails to approve its pending PDUFAs it may never do so.

Not only does Syndax’s value as an investment depend on the vagaries of the FDA’s approvals of its axatilimab BLA and its revumenib NDA. Assuming it gets FDA approval, its success as an investment is also dependent on its successful commercialization of these two molecules.

In this regard, one can’t help being a bit skeptical on account of its lack of a track record. Two factors will be important should it actually get FDA approval. The first is its financial muscle, particularly its liquidity. In this regard, Syndax reported in the Call that it was:

…well-funded with $522 million in cash as of March 31, that we expect will provide significant capital through 2026. Our current balance sheet not only supports our planned commercial launches and clinical trials, but also allows us to expand beyond our core registration indications and pursue select business development opportunities.

If accurate, a cash runway through 2026 appears to provide ample liquidity for Syndax to get started with its launches. During the Call, it guided for aggregate 2024 operating expenses in a range of $355 million to $375 million, of which $43 million is non-cash stock-based compensation.

This represents a midpoint annual cash burn of $317 million. With Q1, 2024 liquidity of $522 million, Syndax would run short of cash in Q4, 2025 absent revenues or additional financing. Revumenib is the better opportunity for quick cash, so if the FDA only issues one approval, investors should root for it rather than axatilimab.

In the 10-Q Syndax lists the competitive situation for these two as:

- Revumenib – being developed for the treatment of R/R adult and pediatric patients with KMT2Ar ALL, KMT2Ar AML and NPM1 mutant AML. A t this time, there are no drugs approved for these defined populations and patients are managed using the standard of care treatment regimens developed for general AML and ALL populations. While there are other agents in early development for similar populations, revumenib has the potential to be the first defined therapy for patients with KMT2Ar ALL, KMT2Ar AML and/or NPM1 mutant AML;

- Axatilimab — being developed for the treatment of chronic graft versus host disease or chronic GVHD after failure of at least two prior lines of systemic therapy. [C]hronic graft versus host disease has historically been managed by off-label treatments. However, in the past several years, the FDA has approved three drugs, ibrutinib (Imbruvica), belumosudil (Rezurock) and ruxolitinib (Jakafi), for use in patients with cGVHD after failure of one or more lines of systemic therapy. All three of these drugs may compete with axatilimab in patients diagnosed with cGVHD.

Given this competitive situation coupled with the larger revumenib market, It is certain that a revumenib approval is to be hoped for rather than axatilimab.

Conclusion

With its current market cap, I rate Syndax stock a Hold. It is an interesting opportunity to watch on pullbacks.