Top 3 Travel Stocks (SA Quant)

MediaProduction

Sixty percent of Americans plan to take a leisure trip over the next few months. Meeting new people and “digital detoxification” are among the top reasons driving vacations, according to a McKinsey study, as younger generations show a significant growing interest in travel. Airlines forecast carrying a record 271M passengers around the world this summer, from June 1st to August 31st (+6% YoY), and cruise lines project ~34.7M passengers in 2024 (+9% YoY). Major hotels in Las Vegas, the #1 domestic destination in TripAdvisor’s Summer Travel Index, predicted an increase in occupancy and room rates would continue through the end of 2024. As Nevada casinos notch record-high gaming wins, consider three top quant-rated travel stocks.

Top 3 Travel Stocks

June is already upon us, and as the summer months kick into high gear, we identified three stocks with Strong Buy and Buy Quant Ratings. These stocks offer a solid record of profitable growth, including major players in the cruise line, airline, and casino industries.

1. Royal Caribbean Cruises Ltd. (RCL)

-

Market Capitalization: $38.98B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/20/24): 15 out of 510

-

Quant Industry Ranking (as of 6/20/24): 3 out of 37

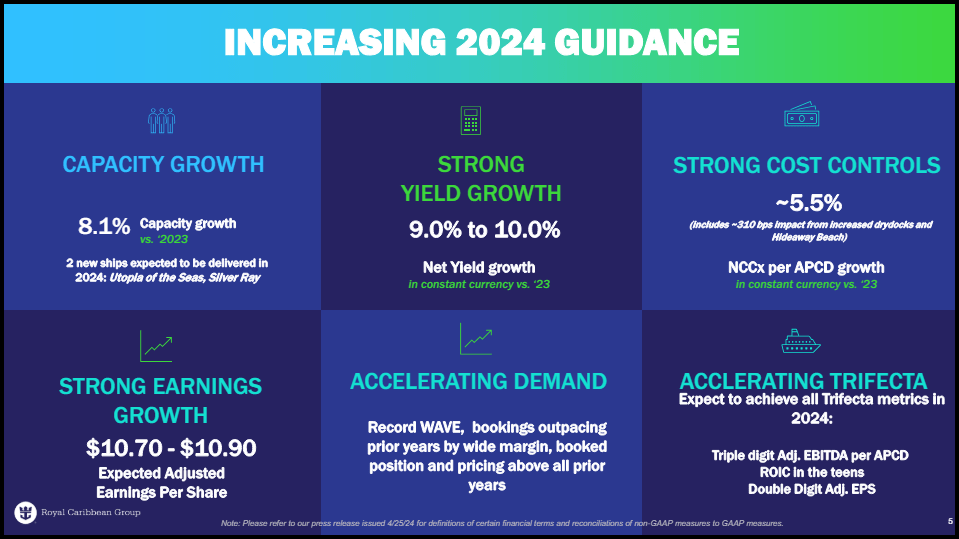

RCL is the #3 quant-rated Hotels, Resorts and Cruise Lines stock, up more than 55% in the past year. One of the “Big Three” cruise operators, Royal Caribbean has more than 65 ships that offer itineraries to nearly 1,000 worldwide destinations on all seven continents. RCL showcases A’s in Growth, Profitability, Momentum, and EPS Revisions. RCL in 2024 guidance is targeting 8.1% capacity growth vs. 2023, with 2 new ships expected to be delivered, record level booking and price levels, and +9-10% net yield growth. RCL expects to achieve all “trifecta” metrics: triple-digit adjusted EBITDA per APCD, ROIC in the teens, and double-digit adjusted EPS.

RCL 2024 Guidance (Investor Presentation)

RCL Growth Grade is driven by YoY sales growth of 38% vs the sector’s 2.2% and EBIT growth of an astounding +793%. Revenue growth rate forward is 26% and operating cash flow growth FWD is 125% vs. the sector’s 11%. RCL posts impressive sector-crushing Profitability metrics, including EBITDA margin (32%), net income margin (14%), and an astounding ROE of 52%. RCL has a C- in Valuation but is trading at 13.77x earnings, a 12.98% discount to the sector. RCL has 20 up revisions in the last 3 months. According to consensus estimates, RCL EPS is projected to grow 62% in FY24 to $11.00.

2. United Airlines Holdings, Inc. (UAL)

-

Market Capitalization: $16.30B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/20/24): 37 out of 627

-

Quant Industry Ranking (as of 6/20/24): 3 out of 26

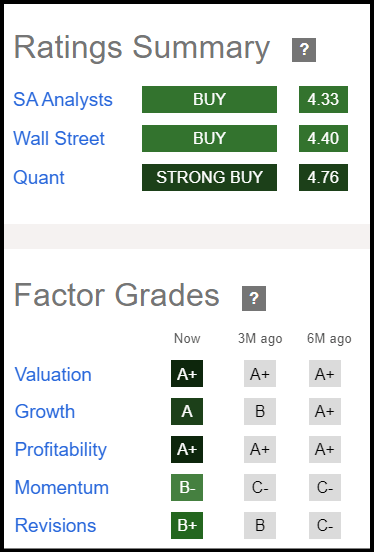

UAL is the #3 quant-rated Airlines stock, +18% YTD, showcasing A’s in Valuation, Growth and Profitability along with B’s in Momentum and EPS Revisions. UAL, a top Strong Buy value stock, is trading at a mere 4.85x earnings, a 73% discount to the sector, for an A+ in Valuation. UAL PEG FWD is 0.64 vs. the sector’s 1.67, and price/cash flow FWD of 2.15x is over 80% below the sector. UAL’s EV/EBITDA FWD of 4.55x and EV/EBIT FWD of 7.03x are also all significantly below the sector medians.

UAL Factor Grades (SA Premium)

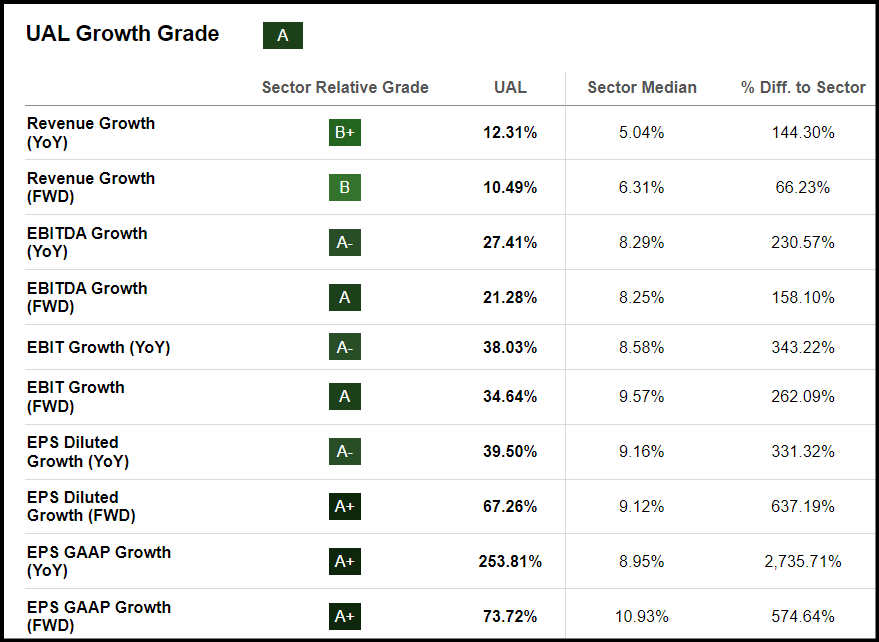

UAL ROE is at 33%, capex/sales 12%, and cash per share $25.55, driving an A+ in Profitability. UAL’s Growth grade is driven by EBITDA growth rate FWD of +21%, EBIT FWD of +34%, and EPS FWD of a whopping +67% vs. the sector’s +9%. UAL Q124 EPS of -$0.15 beat by $0.42 and revenue of $12.54B (9.71% YoY) beat by $144.80M. UAL has 15 upward revisions to 2 down revisions in the last 3 months and Wall Street sell-side analysts’ average price target implies +40% upside.

UAL Growth Grade (SA Premium)

3. MGM Resorts International (MGM)

-

Market Capitalization: $12.71B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 6/20/24): 72 out of 510

-

Quant Industry Ranking (as of 6/20/24): 5 out of 30

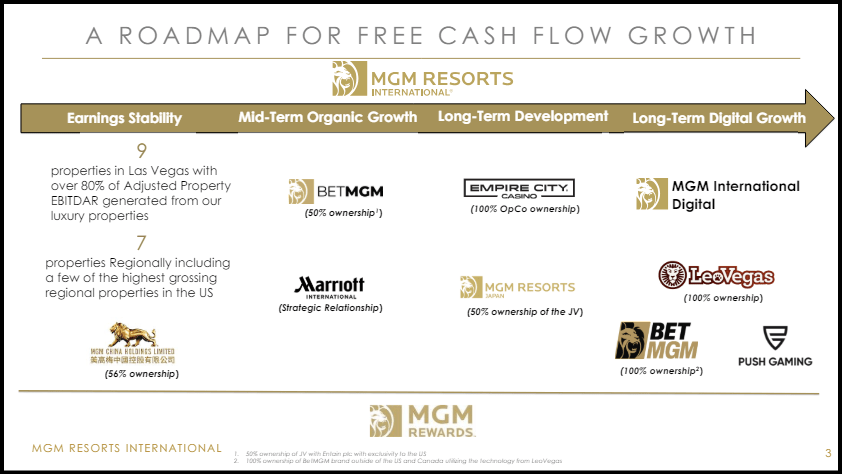

MGM owns and operates casino, hotel, and entertainment resorts in the United States and internationally, #5 among quant-rated Casino and Gaming stocks. In Q124, MGM achieved record revenue of $4.38B (+13.17% YoY), primarily from 3 segments: Las Vegas Strip (~51% of sales), MGM China (24%), and regional (~21%). MGM’s China segment revenue exploded by 70% YoY in Q1 and Adjusted Property EBITDAR +78%. MGM in its Q124 earnings call said it expects to see digital businesses begin to generate “significant free cash flow” in the next couple of years, including online sports betting site BetMGM and international mobile gaming app LeoVegas. In FY23, BetMGM recorded annual sales of $1.96B (+36% YoY) and an EBITDA loss of $67M.

MGM Free Cash Flow Roadmap (Investor Presentation)

MGM has an SA Quant Buy Rating with a solid B+ in Profitability, driven by an ROE of 21.5% vs. 11.67% for the sector and an EBITDA margin of 14%, more than 30% above the sector median. MGM has a C+ in Growth but strong sector-relative grades in revenue growth YoY (+17%) and revenue growth FWD (+9%). MGM also outperforms the sector in EBITDA growth YoY (+31%) and operating cash flow FWD (+17%). MGM is trading at 14.71x earnings, a 7% discount to the sector, and price/cash flow FWD is 6x vs. the sector’s 9.5x. MGM Q124 EPS of $0.74 beat by $0.16 and revenue of $4.38B beat by $156.62M. MGM has 10 upward revisions to 2 down revisions in the last 3 months and Wall Street sell-side analysts’ average price target implies +35% upside.

Concluding Summary

Travel and tourism are hot with airlines projected to carry a record 271M passengers this summer, cruise lines 35.7M by year-end, while Las Vegas resorts see increases in occupancy and room rates. SA’s quant team identified three stocks with solid investment fundamentals that stand to benefit from the travel boom. If you’re seeking a limited number of monthly ideas from the hundreds of top quant Strong Buy rated stocks, the Quant Team’s best-of-the-best, consider exploring Alpha Picks.